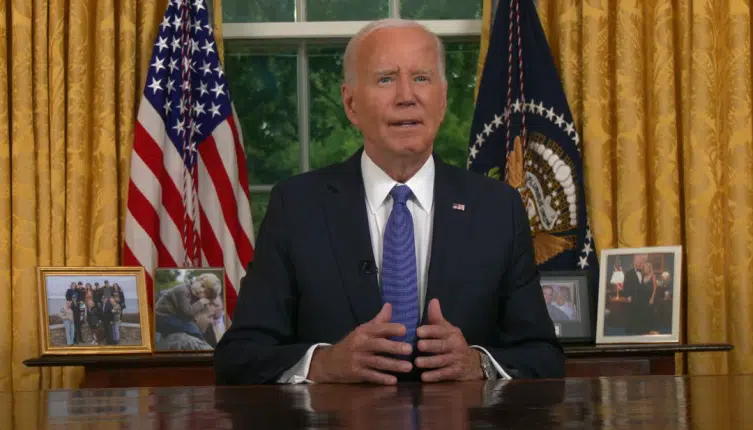

Half of Americans alive today have never experienced the kind of runaway inflation that Joe Biden’s out-of-control spending has unleashed on the country. That’s because they weren’t even born until Jimmy Carter’s inflation was well under control in Ronald Reagan’s second term.

Because I was just a kid during Carter’s presidency, and my family lived overseas for half of his presidency, I have only vague memories of those years. I remember seeing pictures on the news of gas lines, but I was never directly affected.

Like most people, I didn’t begin paying attention to the economy until I was in my twenties and trying to support myself and save to buy a home. For me, those were the Clinton years. The economy was really humming. I watched the stock market go up and up, with no end in sight, and thought “Policy makers have dialed things in so well we will never deal with inflation or recessions again.” For thirty years I was right. But last month inflation hit 7.5 percent over the previous year, exceeding the 40-year high set in December. We are paying forty percent more for gasoline than we were a year ago.

The American worker is feeling the pain. According to the Bureau of Labor Statistics, real earnings are down year over year by 1.3 percent: “From January 2021 to January 2022, real average hourly earnings decreased 1.3 percent, seasonally adjusted. The change in real average hourly earnings combined with a decrease of 1.5 percent in the average workweek resulted in a 2.7-percent decrease in real average weekly earnings over this period.”

Just one year into the Biden administration, Americans are working less on average, paying more for consumer goods, and thus earning less.

We may be at the start of what economist call a wage-price spiral. It describes the phenomenon of price increases as a result of higher wages. When workers receive a wage hike, they demand more goods and services and this, in turn, causes prices to rise.

Historically, the way policy makers have attempted to avoid that spiral is to bring down inflation by raising interest rates. In effect, creating a recession.

Americans for Limited Government President Richard Manning well remembers the Carter years and says that is one of the reasons he has spent most of his career fighting for limited government and free-market policy solutions. I sat down with him to pick his brains about what may be coming next for Americans under the Biden economy.

Daily Torch: What are some of your strongest memories of life during the inflation and recession of the 1970s?

Richard Manning: I remember my Mom saying, “The harder I work, the further behind I get.” As her paycheck couldn’t keep up with inflation. Obviously we had gas lines, odd/even days to get gasoline during Arab Oil Embargo, and for a short while gasoline was sold by the liter because the pumps were unable to charge more than 99.9 cents a gallon, until the pumps were upgraded to accommodate the three figure price per gallon. President Nixon imposed wage and price controls which made everything worse, and then President Ford had a goofy Whip Inflation Now campaign where they sent out W.I.N. buttons. I guess one could say that Ford had the first #hashtag campaign at a time when this # symbol meant number.

Daily Torch: Is this why economist Milton Friedman referred to inflation as “the cruelest tax?”

Richard Manning: Inflation is the cruelest tax because you cannot avoid it, and it hits those at the bottom rung of the income ladder the hardest. When you are struggling from paycheck to paycheck, you tend to have fewer things that you can cut from your budget at a time when you money is worth less forcing those very cuts.

Daily Torch: How do we avoid those mistakes today, or is it too late for that?

Richard Manning: I think it is too late to avoid the negative repercussion of government spending driven inflation, but I do think that if Congress shows fiscal discipline now and tries to at least limit spending, the inevitable recession that inflation brings on will be shallow. This is why America owes a big thanks to Senator Joe Manchin who recognized the inflationary cycle for what it is, and told his political party, no on the Biden build back better fiasco.

Daily Torch: Is there anything Americans can do in the short term to protect our pocketbooks from Biden’s inflationary spending?

Richard Manning: I am not a financial advisor and I won’t pretend to be one here. I think the best thing that people can do from a personal level is to start cutting some of the luxuries out of their budgets and if they owe a lot of money on credit cards and other debt, to try to pay down your highest interest rate debt while saving money in the event that job situations become unstable. One positive about inflation is that if you owe $5,000 in credit card debt inflation also devalues the debt itself. So if you get rid of the highest interest rate debt you have, your other debt might not compound more than the inflation rate, meaning you owe less in a dollar to dollar basis. The best thing to do would be to contact your federal elected officials and urge them to stop the deficit spending which fuels inflation. That way, we get out of the inflationary cycle all the faster, because there are very few winners when the dollar is being devalued rapidly on a month to month basis.

Catherine Mortensen is Vice President of Americans for Limited Government.