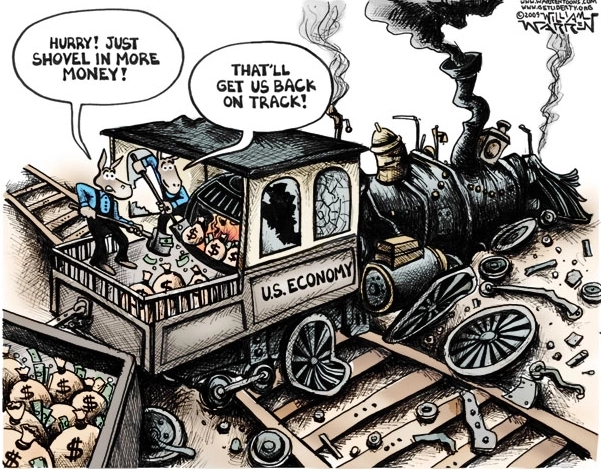

Gross interest owed on the $31.4 trillion national debt—that is, interest owed on both the $24.9 trillion publicly traded debt and the $6.7 trillion debt in the Social Security, Medicare and other trust funds—will reach a gargantuan $1 trillion in 2024 for the first time in American history, according to the latest data gathered by the White House Office of Management and budget.

To put that into perspective, that is more than is spent on national defense related spending, currently $814 billion.

And more than Medicare, at $821 billion. Or Medicaid, at $607 billion.

The only larger single item currently on the budget is Social Security, set to hit $1.35 trillion in 2023. From there, it will continue growing dramatically: $1.46 trillion in 2024, $1.55 trillion in 2025, $1.65 trillion in 2026, $1.74 trillion in 2027 and $1.84 trillion. That’s 7.2 percent average annual growth from 2023 to 2028. (I’ve compiled all these into a single Excel sheet for reference.)

Medicare too will keep right on growing: to $841 billion in 2024, $957 billion in 2025, $1 trillion in in 2026, $1.1 trillion in 2027 and $1.25 trillion in 2028. That’s 9.05 percent average annual growth from 2023 to 2028.

As for Medicaid, it will actually dip supposedly to $558 billion in 2024 as the Covid era so-called “continuous enrollment” provision ends at the end of this year, although the implication is that vast majority, 16.5 million out of the 23.3 million Medicaid expansion that occurred during Covid will not ultimately be rolled back because those persons are said to still qualify in some way. From there, it will keep growing, to $581.5 billion in 2025, $620 billion in 2026, $655.9 billion in 2027 and $699.2 billion in 2028. Once factoring out the end of “continuous enrollment,” it will grow 5.8 percent a year from 2025 to 2028.

In the meantime, defense and other security spending will keep growing as well: to $909.3 billion in 2024, $931.5 billion in 2025, $932 billion in 2026, $946.7 billion in 2027 and $966.8 billion in 2028. That’s 4 percent growth from 2023 to 2028, not nearly keeping pace with so-called mandatory spending.

And so will gross interest owed on the debt keep growing from $1 trillion in 2024: to $1.04 trillion in 2025, $1.1 trillion in 2026, $1.16 trillion in 2027 and $1.21 trillion in 2028. That’s 9.4 percent average annual growth from 2023 to 2028.

At those levels, we also have a current average interest rate of 2.74 percent that is paid on the $31.4 trillion national debt, which will similarly keep growing from its current levels once the national debt ceiling is raised in the coming weeks: to $32.7 trillion in 2023, $34.8 trillion in 2024, $36.8 trillion in 2025, $38.7 trillion in 2026, $40.4 trillion in 2027 and $42 trillion in 2028. That’s average annual growth of 5.3 percent from 2023 to 2028.

But those numbers might be understated, seeing as how the national debt has increased by an average annual 8.8 percent a year since 1980 once recessions and countercyclical spending—that is the fact and propensity of the government to spend more than it takes in during recessions as revenues take a hit—are truly taken into account. The only other times that’s happened recently was from 2015 to 2019, when it grew by about 5 percent a year, which only happened because the bulk of Baby Boomer had no retired yet and Congress engaged in budget sequestration, something they no longer appear willing to do. And from 1995 to 2007, when it grew at 5.3 percent. The trouble is every time we get a recession—and we appear to be headed into another one right now—it blows the barn doors off the budget.

Now, gross interest is not the number that one will normally hear reported. Gross interest owed on the debt also includes interest owed to the trust funds, but because the trust funds are government entities, the interest is counted as revenue. Additionally, interest paid on the $5.2 trillion of treasuries owned by the Federal Reserve is remitted back to the Treasury.

And so, the government tends to publicly report the so-called net interest paid on the national debt, currently at $660.6 billion in 2023.

From there, net interest will keep growing too: to $788.7 billion in 2024, $832.5 billion in 2025, $867.2 billion in 2026, $910.1 billion in 2027 and $960.9 billion in 2028. That’s 13.07 percent average annual growth from 2023 to 2028, faster than any other big-ticket item on the budget.

But, the interest paid by the Fed each year ($76 billion in 2022) to the Treasury notwithstanding, where does the money come from to pay the interest owed to the Social Security, Medicare and other trust funds? They’re treasuries, even if they are not marketable treasuries, and so it can only come from the Treasury, but since there’s not enough revenue to balance the budget, it must be borrowed.

According to the Social Security Administration, the trust funds at the moment only deal with non-marketable securities: “The Old-Age and Survivors Insurance Trust Fund and the Disability Insurance Trust Fund comprise the Social Security trust funds. Both funds are managed by the Department of the Treasury through their Bureau of the Fiscal Service. Since the beginning of the Social Security program, all securities held by the trust funds have been issued by the Federal Government. There are two general types of such securities: Special issues—available only to the trust funds; Public issues—marketable Treasury bonds available to the public. The trust funds now hold only special issues, but they have held public issues in the past.”

And of the special issues, “There are two types of special issues: short-term certificates of indebtedness and long-term bonds. The certificates of indebtedness are issued on a daily basis for the investment of receipts not required to meet current expenditures, and they mature on the next June 30 following the date of issue. Special-issue bonds are normally acquired only when special issues of either type mature on June 30. The bonds generally have maturities ranging from one to fifteen years.”

And according to the Treasury’s Bureau of the Fiscal Service, in its 2022 report, “government funds (e.g., Social Security and Medicare Trust Funds) typically must invest excess annual receipts, including interest earnings, in Treasury-issued federal debt securities. Although not reflected in Chart 4, these securities are included in the calculation of federal debt subject to the debt limit… Federal debt held by the public plus intra-governmental debt equals gross federal debt, which, with some adjustments, is subject to a statutory debt ceiling (‘debt limit’).”

What will eventually happen is as expenditures for Social Security and Medicare continue to exceed revenues as has been the case since 2021, the non-marketable treasuries in the trust funds will be cashed in, with Social Security trust fund projected to be exhausted by 2033 according to the latest projections, and the Medicare trust fund by 2028. From there, revenues will only cover 90 percent of benefits, and so Congress will either raise taxes, let the spending be cut or else just borrow the shortfall like they do everything else.

From there, whatever is not covered will just be borrowed from the public, which includes a dwindling share of the debt owned by foreigners. In the Dec. 2008, foreign central banks and financial institutions owned $3 trillion out of the $9.9 trillion national debt, or 30.8 percent. In Jan. 2023, they owned $7.4 trillion out of the $31.4 trillion debt, or 23.5 percent.

In that time, the Fed took its share of the debt from $790 billion in Aug. 2007 when the global financial crisis began, or 8.8 percent of the then $8.9 trillion national debt, to $5.28 trillion out of the $31.4 trillion debt as of April 2023, or 16.8 percent. So, whatever slack there is from foreigners in terms of purchasing more debt, the central bank is offsetting.

In a similar vein, the trust fund debt has become a dwindling share of the debt, from $4.3 trillion out of $9.9 trillion in Dec. 2008, or 43 percent, to $6.8 trillion out of $31.4 trillion, down to 21.6 percent.

So, the rest of it is coming from U.S. financial institutions, with its share of treasuries rising from about 17 percent in 2008, or $1.7 trillion, to a massive $11.9 trillion, or 38 percent today—the largest single holder of the debt. That includes the banks themselves, but also retirement funds, mutual funds and so forth.

The thing that keeps this whole system going is the dollar’s reserve currency status, the fact that when recessions strike, as they are wont to do, central banks and financial institutions all over the world stockpile treasuries as if they were as good as good, because the U.S. always meets its financial obligations, but also usually to weaken foreign currencies against the U.S. dollar to boost exports to the U.S.

Many often question whether the U.S. could sustain a divestment by foreigners of U.S. treasuries, to which I would note, it has already sustained taking foreigners from owning 30.8 percent of the debt to 23.5 percent. But a better question might be whether U.S. financial institutions—said to be sitting on some $620 billion of unrealized losses because of higher interest rates necessitated by the inflation caused by all the spending and borrowing to date—can continue shouldering the burden going forward, especially with the ill effects of the recession beginning to be felt. We might be about to find out.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.