Consumer inflation remained elevated in April, coming in at 4.9 percent over the past 12 months, according to the latest data published by the Bureau of Labor Statistics, in part due to a cut in oil production by OPEC+ globally that pushed gasoline prices higher, which increased 2.7 percent last month.

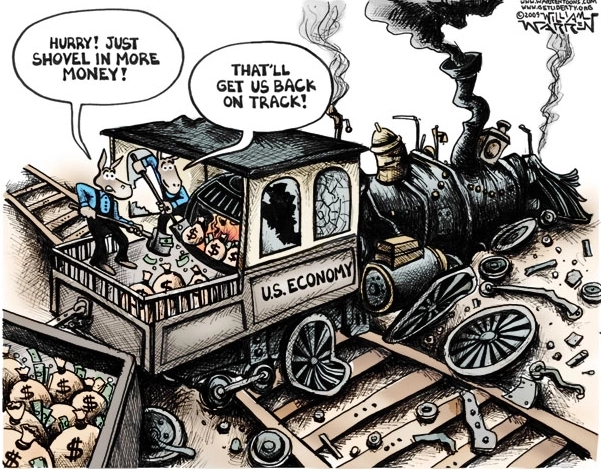

The news comes after the Federal Reserve moved to increase the Federal Funds Rate to 5 percent to 5.25 percent on May 3, showing that the worst of the inflation may not be past us just yet, even as we are past the June 2022 peak of 9.1 percent annualized after printing, spending and borrowing more than $6 trillion for Covid, which came at a time economic lockdowns and production halts.

It was too much money chasing too few goods, sending prices spiraling—along with interest rates in a bid to calm the inflation.

Thanks to massive government spending — publicly traded debt will increase by $1.66 trillion in 2023 and $1.87 trillion in 2024 to $27.8 trillion, and when the Social Security, Medicare and other trust funds are added to the mix, the total debt will rise $34.8 trillion in 2024 — the too much money aspect of the equation will continue mounting over the next decade as the total debt rises to $50.7 trillion by 2033, according to the White House Office of Management and Budget.

Unfortunately, one of the now apparent side effects of such massive deficits is the increasing burden it places on U.S. financial institutions, retirement funds, hedge funds, mutual funds and so forth to continue accumulating U.S. treasuries, whose share of the publicly traded debt has risen from about 17 percent in 2008, or $1.7 trillion, to a massive $11.9 trillion, or 38 percent today — the largest single holder of the debt.

And as the Social Security and Medicare trust funds, which hold $6.7 trillion, become exhausted over the next decade or so, more and more of that debt will be falling upon the public to accumulate. Foreign central banks and financial institutions, which hold $7.4 trillion, cannot keep up with it. And when the Fed tries to keep up with it, as during Covid, the result is inflation. The central bank now holds $5.2 trillion.

That leaves U.S. banks and investors via their fiduciaries (which are banks) to continue accumulating what is turning out to be something of a major risk to their solvency when interest rates don’t behave.

The next decade alone, net interest owed on the debt is set to rise from $665 billion a year to a nearly $1.4 trillion a year by 2033. It’s enough to make your eyes bleed.

During recessions, the Fed tends to cut interest rates in a bid to boost liquidity and ease lending conditions, to foster conditions for lowering the unemployment rate. But when there’s inflation, the Fed has to hike interest rates to fight it, thereby reducing the value of the bonds the Treasury was selling at much lower interest rates. In this cycle alone, it has resulted in the failures of First Republic Bank, Silicon Valley Bank and Signature Bank, the second, third and fourth largest bank failures in American history.

The Federal Reserve’s new Bank Term Funding Program — “renting” treasuries from banks at 100 pennies on the dollar — has risen from $11 billion in March to more than $75 billion today, and the worst could be yet to come, as banks are said to be sitting on some $600 billion of unrealized losses due to rising interest rates resulting in underwater securities.

As for the productions shortfalls, those might not get much better, with U.S. oil companies going green in a bid to reduce carbon emissions, with crude oil production still below that of pre-Covid levels of 13 million barrels a day. In Feb. 2023 it stood in at 12.48 million barrels a day, according to the U.S. Energy Information Administration, despite the high prices we were experiencing in 2022 particularly after Russia invaded Ukraine, further exacerbating supply chain issues in the global economy.

So, if we keep spending too much money—and printing it—and not producing enough goods, that means inflation could be quite sticky over the foreseeable future. That is, until the economy truly overheats, causing a recession and a drop in demand, sending prices crashing as unemployment rises. Then the Fed will cut interest rates, the budget deficit will balloon thanks to less revenue and the debt cycle will continue anew as banks continue accumulating vast hordes of useless treasuries, further diverting resources from boosting production. What’s not to love?

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.