Household median income took a major hit in 2022, dropping 2.3 percent to $74,580, amid high inflation that peaked at 9.1 percent annualized in June 2022, according to the latest figures from the U.S. Census Bureau.

The news comes as inflation is once again heating up in the U.S. economy, with consumer prices rising 3.7 percent annualized in August according to the Bureau of Labor Statistics, up from 3.2 percent in July and 3.0 percent in June, as oil and gasoline prices have once again started increasing. In the past month, gasoline prices increased 10.6 percent and fuel oil increased 9.1 percent.

In addition, transportation services were up 2 percent and medical care commodities increased 0.6 percent, while food increased another 0.2 percent.

Even taking food and energy out of the equation, core inflation grew at 0.3 percent and has grown 4.3 percent the past twelve months.

Which is what happens when you print, borrow and spend close to $7 trillion for Covid into existence since the beginning of 2020 at the same time the global economy was locked down and production halts exacerbated the global supply chain crisis for months and years. All told, the M2 money supply, which peaked at $22 trillion after it increased dramatically from $15.3 trillion in Feb. 2020 to a peak of $22 trillion by April 2022, a massive 43.7 percent.

It was too much money was chasing too few goods, the literal definition of inflation. Prices had cooled to 4.9 percent in April, 4 percent in May and 3 percent in June, following the price surges of 2021 and 2022, when consumer inflation first rose above 5 percent annualized in June 2021 to 5.4 percent, up to 7.5 percent by Jan. 2022 immediately prior to Russia’s invasion of Ukraine, and peaking at 9.1 percent in June 2022.

Now, amid higher interest rates—30-year-mortage-rates are up to 7.1 percent, for example—the M2 money supply has actually been shrinking after its April 2022 peak, down 5.8 percent to $20.75 trillion.

The problem is that it’s still 35.6 percent greater than Feb. 2020, and still well above the historical trendline. Prior to Covid, going back to 1981, the M2 money supply would grow at 5.9 percent annually on average. Right now, it’s still averaging 10.9 percent annualized growth since Feb. 2020, hence the continued runup in prices in some quarters.

Producer prices also saw a notable uptick in August, increasing to 1.6 percent annualized, up from 0.8 percent in July, amid a single-month 10.5 percent increase in energy costs and a 1.4 percent increase transportation and warehousing costs.

And it all hurts U.S. households, whose income was outstripped by prices in 2021 and 2022, according to Bureau of Labor Statistics data. Prior to Covid, average weekly earnings were growing at 2.5 percent on average since 2007, while consumer prices grew at 1.8 percent, representing an overall improvement in household budgets all the way to the end of 2019.

But after Covid, the picture shifted dramatically, where although average weekly earnings annualized are up 4.9 percent, consumer prices have been growing even faster, at 6 percent annualized since.

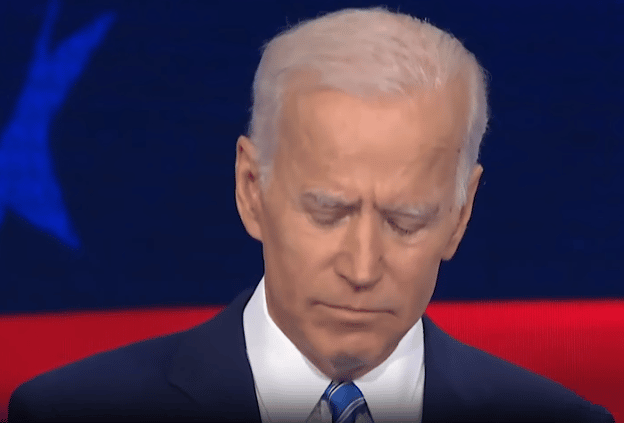

In other words, the American people are definitively worse off than they were four years ago, and with the 2024 presidential election looming, so are President Joe Biden’s chances of getting reelected.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.