03.17.2016

By Dustin Howard How should policymakers stop the bleeding of American jobs overseas? There’s one easy answer among many harder ones, and that is to stop making it so expensive to do business in the United States. Many things price American workers out of competition, […]

03.07.2016

By Robert Romano In Japan, the 10-year treasury has been negative for several days now. On Feb. 29 the government sold its first auction at a negative rate, about $19.5 billion at a -0.024 percent rate, as reported by Bloomberg Business . At that rate the government will actually get paid about $4.7 million annually for the next ten years. […]

02.22.2016

By Robert Romano “Suppose the economic outlook, which I don’t expect, but if it were to deteriorate in a significant way so that we thought we needed to provide more support to the economy then potentially anything, including negative interest rates, would be on the table.” That was Federal Reserve Chairman Janet Yellen testifying to the House Financial Services Committee on Nov. 4, 2015 in […]

02.19.2016

By Dustin Howard “We have so many people who can’t see a fat man standing beside a thin one without coming to the conclusion that the fat man got that way by taking advantage of the thin one.” Ronald Reagan powerfully stated this truism in 1964 […]

02.17.2016

By Robert Romano Interest rates in Switzerland, Denmark, Sweden, the European Central Bank and now the Bank Japan have now plunged into negative territory, starting a new phase in the era of central banking that is very much uncharted. Time will tell if it leaves the global economy lost at sea. So far, banks are primarily being charged for keeping excess reserves […]

02.12.2016

By Robert Romano Since 1997, at the height of the dotcom bubble, labor participation of 16 to 64 year olds — that is, those working or looking for work — has been declining almost every single year even as the population has increased. As a result, the […]

02.09.2016

By Robert Romano The economy of Japan has not grown nominally in 20 years, according to data published by the Statistics Bureau of Japan . Nor has its population aged 15 to 64 —those in the prime working years of their lives — which has declined from 86.9 million in 1995 to 76.7 million today. Inflation has […]

02.04.2016

By Robert Romano One of the mysteries surrounding the post-financial crisis economy is why lower interest rates — led primarily by the Federal Reserve setting its benchmark rate to near-zero levels in 2008 — did not do more to spur home-buying, and overall credit expansion. When the […]

02.01.2016

By Robert Romano It’s official. The U.S. economy has not grown above 3 percent since 2005, making it a full 10 years since that level of growth has been seen. And it has not grown above 4 percent since 2000, marking a 15-year era of much slower […]

01.29.2016

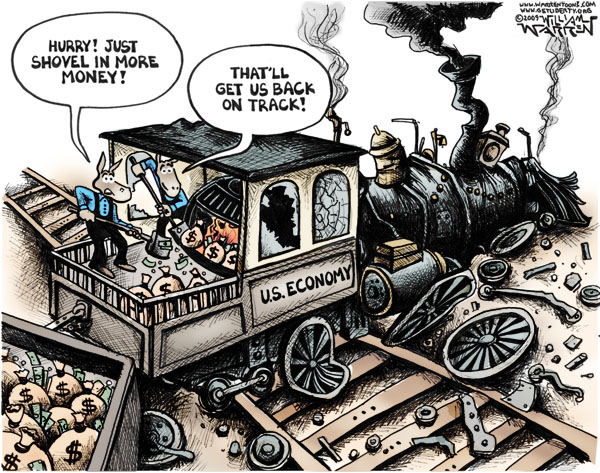

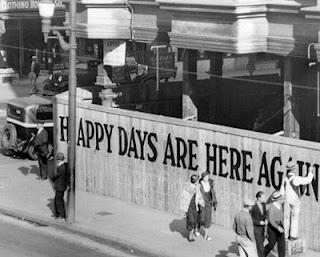

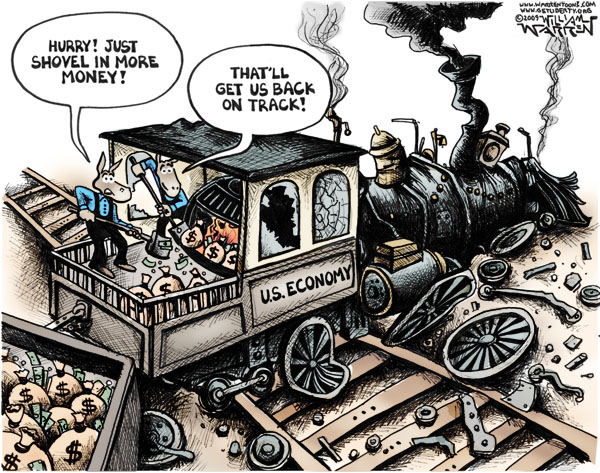

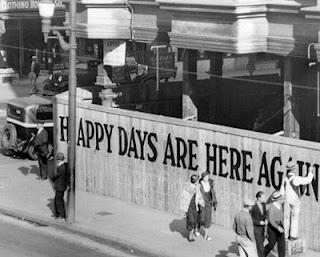

By Rick Manning The U.S. economy has just suffered through the worse ten-year period in terms of economic growth since the Great Depression. This lost decade of despair and hopelessness has led to more than 6 million more Americans aged 16-64 dropping out of the workforce than would normally be expected . With the near-disastrous Gross Domestic Product for the fourth quarter of 2015 being announced at 0.7 percent annualized by the Bureau of Economic Analysis and just 2.4 percent for the year, America cannot be allowed to […]