The Federal Reserve has dumped an eye-popping $343 billion of U.S. treasuries and mortgage-backed securities since it began its policy normalization program in Sept. 2017.

$116 billion of that, or more than a third, has been since Sept. 2018 as the nation’s central bank has begun to accelerate its program.

At the same time, the Fed has been hiking the effective federal funds rate, increasing the costs of borrowing by financial institutions. Now, the effective rate stands at 2.2 percent.

The pertinent question might be what took it so long? After keeping rates near-zero for the entire Obama administration, and holding onto its dragon’s horde of treasuries and other securities for almost a decade, suddenly the Fed has finally begun unwinding its portfolio—long after economic conditions had settled down after the financial crisis.

The high-water mark was reached at the end of 2014, when its holdings were as high as almost $4.3 trillion. It had been a massive $3.5 trillion expansion of its balance sheet going back to Aug. 2007 when the crisis began.

Arguably, the Fed has waited until nearly the end of the business cycle to begin unwinding — that is the period when the U.S. economy becomes due to have a recession — to remove the “emergency” support from the last recession.

In that regard, there is a perverse logic to doing so. Hike rates now, so they can cut them later after they cause the next recession. Sell the bonds now, so they can buy them back later. That is, the central bank needs to give itself room to maneuver when — not if — the next recession does indeed come.

To be fair, the economy could still be several months or even a couple years or so away from the next recession. Nobody knows. So, if the goal is to give the Fed room to maneuver, let us ask what would be the logic of not doing so?

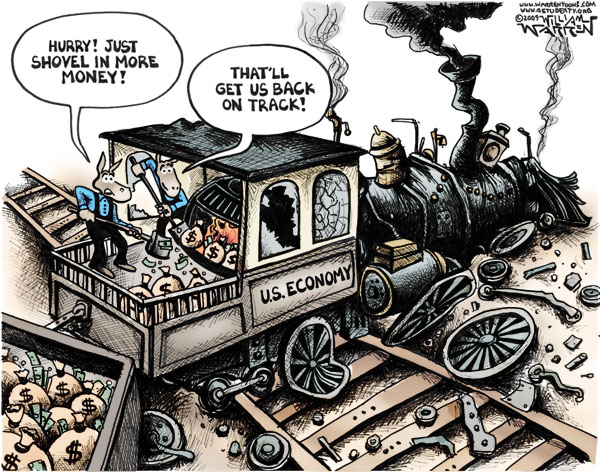

What if the rates were near-zero and the Fed was still loaded up with trillions of dollars of securities when the next recession does finally hit? What could it possibly do to accommodate the economy then? Make interest rates go negative? Buy several trillions of dollars more of U.S. debt?

The case of Japan could be instructive, where rates have been pushed down for decades and even went negative in 2016, and still the economy there struggles to grow at all.

The fact is, rates have not been this low, relatively, in the U.S. for a few generations. Of course it wasn’t going to last forever. Or I suppose, it could, technically, but the economic distortions of leaving the funny money running for too long could be catastrophic.

Which is worse, the normal cyclical recession, or going too easy for too long and getting a blowup like the 1930s or the 2010s?

Then there’s the problem with growth. The past decade of economic growth has been as bad as what we saw in the Great Depression. Growth as not averaged above 3 percent since 2005, and not above 4 percent since 2000. It’s fair to say that the lower the interest rates have gone, so too have we lowered our growth expectations.

The fact that rates are rising right now might actually tell us that Fed policymakers see a risk of the U.S. economy expanding too rapidly in an unhealthy manner, and so are moving the short rate and adjusting its portfolio holdings to accommodate.

It’s a tough decision to make, for certain. There are trillions of dollars at stake in investments, in the productive economy and with people’s jobs. Nobody wants to see the next recession. Unemployment rises. Growth stops or contracts. It’s not pretty. But these corrections are also inevitable.

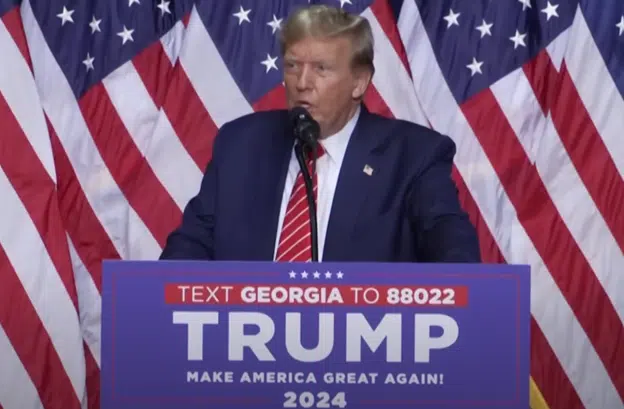

In an ideal world, the Fed would not be making these decisions. Markets would set interest rates. Institutions would be responsible for buying or not buying treasuries and other government-backed securities like mortgages, if they chose. But that is not the world we live in, and it is not the world that President Donald Trump and Federal Reserve Chairman Jerome Powell inherited. The Fed sets the short rate, and is responsible for buying government securities.

Some will argue that by not undertaking policy normalization until after Obama left office, the Fed was acting politically. Historians will doubtless debate this ad nauseum the next many decades. There is certainly a case to be made that, once again, the central bank left rates too low, for too long, and failed to unwind its portfolio holdings when there was arguably less of a risk of doing so. Now, it makes the odds greater that when the next recession hits, so too will zero or negative interest rates and more quantitative easing follow — which is what we were warning all along. Perhaps that was the point. Now what?

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.