By Rick Manning

Ken Griffin, founder and 80 percent owner of the hedge fund Citadel LLC, warned his investors, “As we have cautioned over the past year, the surging U.S. public debt is a growing concern that cannot be overlooked.”

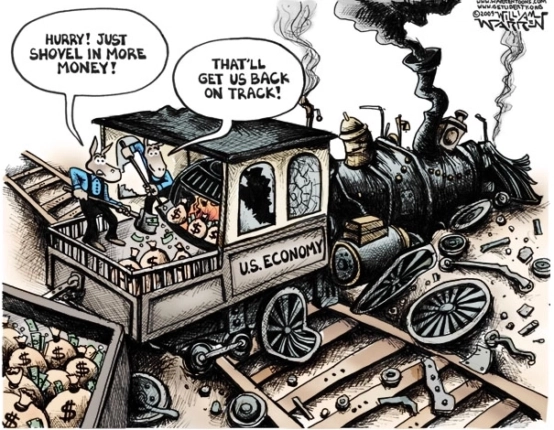

It seems these types of warnings happen over and over again, but is anyone listening?

The answer is both yes and no.

Most GOP members of Congress are acutely aware of the dangers of our nation’s fiscal path, but are trapped in a political vortex.

A significant number of House and Senate Republicans are in favor of increasing spending on national defense, citing the rising threats of China and Russia, along with the war on terrorism. Democrats will agree to defense spending increases so long as they are accompanied by social spending increases, usually expansions of so-called mandatory spending eligibility requirements.

Overall, since 2014, federal government spending has increased from just over $3.5 trillion to $6.1 trillion while revenues have increased from just over $3 trillion to $4.4 trillion.

The challenge is that the spending increases have largely been due to increased costs for so-called mandatory spending programs like Social Security, Medicare, Medicaid and food stamps.

To put an exclamation point on this problem, in 2023, if the federal government eliminated the entire discretionary budget – Defense, Education, Health and Human Services, Homeland Security and the rest – the total federal government revenues would just barely pay for the mandatory spending.

To those who claim that there is a shortage of revenues in this tax season, it is important to note that revenues have increased by almost 50 percent in the past decade, while spending has increased 57 percent in the same time period. These increases are why our annual federal deficit skyrocketed from almost $500 billion on 2014 to $1.7 trillion in 2023.

One example of how this spending has increased is shown in a Kaiser Family Foundation (KFF) report that the numbers of people on Medicaid increased by 22 million from February 2020 to March 2023 largely due to COVID prohibitions on disenrollments.

Now that this direct spending on COVID is no longer a factor, state governments are combing the Medicaid rolls to remove people who are no longer eligible with KFF reporting that the number of people remaining on Medicaid has decreased by approximately nine million or just shy of 10 percent.

One lasting legacy of Obamacare is the increase in Medicaid enrollment eligibility to 300% of the poverty level, meaning a family of four making $93,600 is eligible for government assisted health care in the 36 out of the 50 states (Hawaii and Alaska have different poverty levels.) Currently twelve states have not increased the eligibility standards.

Congress could cut costs by reining in this Medicaid expansion by either limiting the congressionally mandated cost of living adjustments which create automatic spending increases exceeding the growth in revenues to meet those needs, or ratchet down federal government Medicaid payments to states by reducing the eligibility standard from 300 percent of poverty by ten percent a year for ten years leaving it up to states to determine if they wish to use their tax revenue to fully subsidize these largely middle class recipients.

One other obvious place where much easier cuts can be made is to enforce prohibitions on illegal aliens receiving social services benefits. A study by the Federation for American Immigration Reform found that at the beginning of 2023, illegal aliens cost federal, state and local governments $182 billion a year in social services costs while generating $32 billion in tax revenues – a net cost of $150 billion.

Given that our nation has allowed entry into the United States of a glut of new illegals over the past year, it can only be assumed that this cost has escalated accordingly.

While neither of these two areas will balance the budget, they do represent some obvious low-hanging fruit which Congress could and should tackle if they wish to make real headway on our federal government’s runaway spending.

If Congress is really serious about reducing the deficit, House committees should begin the process of evaluating the fiscal impact of making minor changes which over time will result in major savings. The longer they wait, the harder it gets, so they might as well start now, knowing full well that action will be delayed until 2025 at the earliest.

Rick Manning is the President of Americans for Limited Government.