“If birth rates continue to plummet, human civilization will end.”

That was X, Tesla and SpaceX owner Elon Musk, pointing out on X on April 28 the obvious math involved with plummeting fertility rates in countries all over the world, and reacting to the latest birth rate numbers from the Centers for Disease Control (CDC), wherein the numbers have dropped to 1.61 live births per woman.

That’s even lower than it was in 2020 during the Covid pandemic, when it was 1.63 babies per woman, according to CDC data, as the U.S., Japan, South Korea and Europe all continue experiencing significant declines.

And Musk is warning that it is leading to “population collapse” and that countries “will become empty of people and fall into ruin,” writing on April 27, “Record low birth rates are leading to population collapse in Europe and even faster population collapse in most of Asia. Immigration is low in Asia, so there is no “replacement” going on, the countries are simply shrinking away.”

Musk added, “If this doesn’t turn around, then any countries on Earth with low birth rates will become empty of people and fall into ruin, like the remains we see of the many long dead civilizations.”

Elon Musk is right. And it’s all basic math. If women have fewer than two babies each, the population has to decline, fewer than one and it collapses, and if they have no babies, within a very short generation the human race will go extinct. It’s that simple.

In the meantime, the collapse of institutions is easy enough to witness, with labor shortages for schools, health care, postal workers and so forth as the Baby Boomer retirement wave continues.

It is also leading to the explosion of the U.S. national debt, now $34.5 trillion. Since 1963 through 2022, the percent growth of revenues has averaged 6.9 percent a year to its present level of $4.65 trillion, according to data compiled by the White House Office of Management and Budget.

In the meantime, mandatory spending including net interest owed on the national debt has grown an average 8.87 percent a year to its current level of $4.64 trillion.

And discretionary spending has grown an average 5.5 percent a year to its current level of $1.735 trillion.

In fact, since 2011, discretionary spending has only grown 1.99 percent a year.

Meanwhile, since 2011, mandatory spending grew an average 7.7 percent a year.

And revenues grew an average 7.26 percent.

In fact, the entire discretionary budget of $1.736 trillion for 2023 could be eliminated right now — eliminating every department, agency and firing every federal employee including the military — and the budget would still not be balanced as the debt grew by $1.855 trillion in 2023.

In the meantime, Social Security will grow from $1.346 trillion to $2.37 trillion in 2033 amid the Baby Boomer retirement wave, a 76 percent increase.

Medicare will grow from $821 billion to $1.84 trillion, a 124 percent increase.

Medicaid will grow from $608 billion to $928 billion, a 52 percent increase.

These are the drivers of the budget, accounting for 52 percent of all federal spending by 2033. Once interest and other mandatory spending is accounted for, mandatory spending will account 77.8 percent of all federal spending, up from its current level of 72.7 percent.

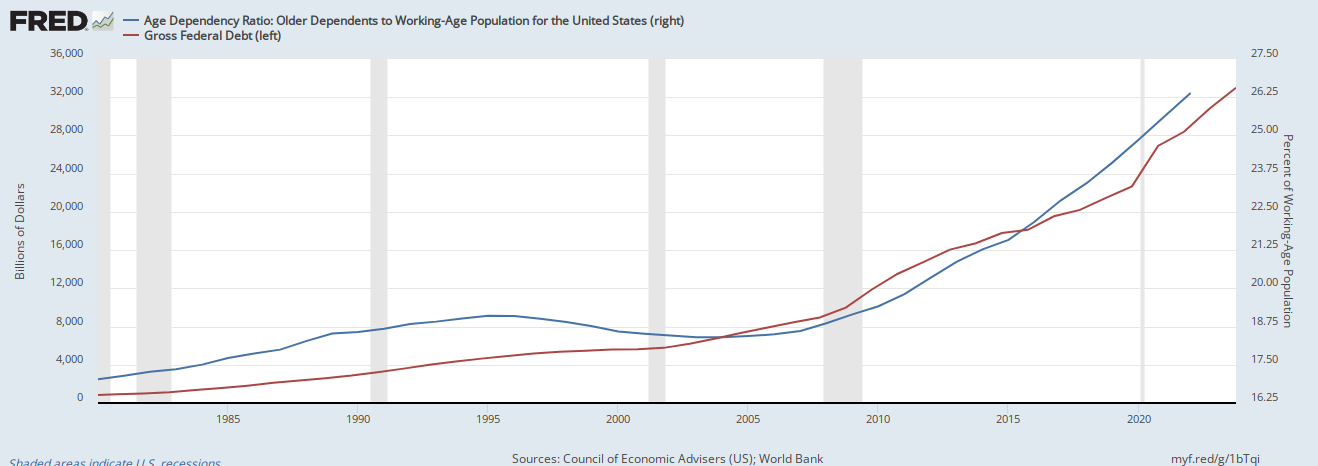

The reason is simple, as the percentage of the working age population over the age of 65 continues to rapidly increase — since 1960, when the FDA approved birth control, it has gone from 16 percent of the population to 26 percent of the population and rising — and with it the $34.5 trillion U.S. national debt, data from the World Bank and the U.S. Treasury shows.

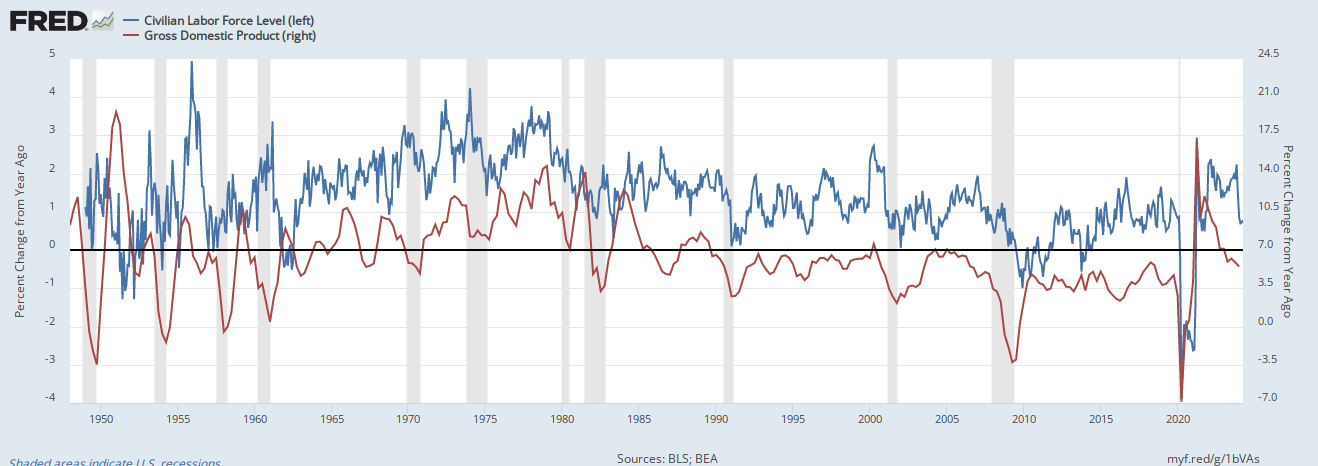

At the same time, as the growth rate of the working age population participating in the civilian labor force has dramatically slowed down thanks to plummeting fertility, so has nominal economic growth, Bureau of Labor Statistics and Bureau of Economic Analysis data shows.

There are two simultaneous outcomes that emerge. First, as the population rapidly ages, so too do Social Security, Medicare and Medicaid expenditures that seniors depend on explode.

In the meantime, thanks to slower growth, revenues will continue not to keep pace with expenditures. Revenues will increase from $4.6 trillion in 2023 to $7.4 trillion, a $2.5 trillion or 51 percent increase over ten years. But expenditures will grow even faster, with outlays growing from $6.37 trillion in 2022 to $9.9 trillion by 2033, a $3.7 trillion or a 55.4 percent increase over the next decade.

The White House Office of Management and Budget projects the national debt to skyrocket to more than $50 trillion by 2033, but that’s low-balling it. The debt has grown by about 8 percent a year since 1980 once recessions and wars are factored. At that rate, it should be about $65 trillion to $70 trillion by 2033 and $100 trillion by 2037 or so, well north of 200 percent debt to GDP.

The reason is because there are comparatively fewer taxpayers versus those receiving benefits as the structural deficit widens due to the drop in fertility, from 3.6 babies per woman in 1960 to 1.61 babies per woman now in 2023 after birth control was approved by the FDA in 1960.

Fewer babies equals fewer workers who pay taxes. The more people who retire, the more we spend, and the fewer people working per retiree, the more we borrow. It’s that simple

Yes, life expectancy has increased, but that would have mattered less if the Baby Boomers, Generation X and Millennials simply had more children, which would have meant more taxpayers.

But that would require a potentially uncomfortable conversation with females in the U.S., the push of which to include in the workforce has caused the plummeting fertility, as it would appear necessary for a certain percentage of them to have children to stabilize the population. There won’t be a glass ceiling to break if the population collapses and along with the economy as we go insolvent.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.