By Bill Wilson –

Yesterday, global markets had quite a scare as news emerged that European banks might shut down lending amid increased fears that the sovereign debt crisis is spreading beyond the borders of Greece. Despite the adoption of the IMF-EU €110 billion bailout, and the passage of austerity measures, traders still are not confident that Greece will not ultimately default upon its obligations.

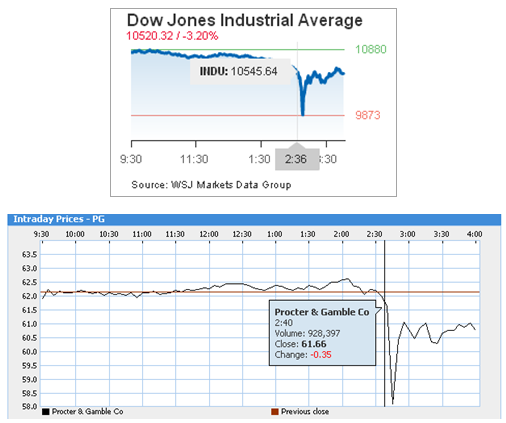

Adding to the wild day of trading was an apparent errant trade made on Proctor and Gamble where, according to the Wall Street Journal, “a major firm may have accidentally released an errant program, where a trader accidentally placed an order to sell $16 billion, instead of $16 million, worth of e-minis, the futures contracts tied to equity indexes.” This precipitated what almost amounted to a loss of 1,000 points by the Dow Jones Industrial Average during the day, before it recovered by the end of the day.

However, the story missing is that prior to P&G’s precipitous drop at about 2:40PM, the Dow was already down about 322 points. See the following charts provided as screen shots from WSJ Markets Data Group and MSN Money. They show about where the markets were right before markets fell into the rough 700 point precipice.

Ultimately, the Dow closed down 347.80 points, about where it might have closed without the errant trades. What this means is that yesterday’s overall trading was not primarily driven by an erroneous trade or two, it means that the trading actually was sour because of the sovereign debt crisis.

Importantly, it underscores just how fearful traders really are about the ongoing debt crisis. All it took was one straw upon this camel’s back — in this case an errant trade — to provoke a crash. Traders must be really nervous.

If a likely sovereign default by Greece results in a 3.2 percent drop in the market, what will the actual default of Greece entail? What about a default of Spain, whose economy is roughly 4 times larger than Greece’s? Or the United Kingdom, which is about 7 times larger?

A loss of 3.2 percent will appear modest if not infinitesimal should any of these nations default, to say nothing of a U.S. default, whose economy is 40 times larger. In the midst of yesterday’s market chaos, traders fled to two safe havens: gold, and U.S. treasuries.

But, what if the U.S. credit rating is ultimately downgraded because of its own severe accumulation of debt?

Where would traders flee then? Certainly not to treasuries. In an instant, the useless paper trade would be a thing of the past. Suddenly, since the world has set aside dollars as the world’s reserve currency, global investors would be forced to convert those assets into something else — quick. A run on the dollar would be the fastest transfer of wealth in human history.

Investors would be forced to go back to the only proven reliable stores of value in history: gold, and other commodities. Worldwide, there would also be a flight to other currencies with more solvent balance sheets. Dollars likely would not be accepted as a form of payment on U.S. debts. In the process, those worthless dollars would find their way back home leading to unbridled inflation.

The only people who would benefit are those wise to convert out of the defaulting nation’s currency. In yesterday’s instance, for example, even though U.S. markets took a hit yesterday, the sinking euro resulted in a rising dollar. The ultimate lesson is that sovereign default is not a good thing for those tethered to the defaulting obligations and who are faced with rising inflation, as noted by Nadeem Walayat.

Right now, the national debt is nearly $13 trillion. Next year, or the year after, it will be over 100 percent of the Gross Domestic Product, which is currently $14.601 trillion. The White House plans on adding another $10.6 trillion in debt by 2020. Moody’s has warned the U.S. that should the nation’s interest owed on that debt rise above 14 percent of revenue, the Triple-A credit rating will be downgraded.

Time is running out. The Congressional Budget Office (CBO) estimates that interest as a percent of revenue will top 14.8 percent as soon as 2015. That year, $520 billion interest will be owed with a projected $3.504 trillion in revenue, according to the CBO. By 2020, that number rises to 20.7 percent: $916 billion owed with projected revenue equally $4.417.

The White House’s own projections are even direr, with interest-owed-to-revenue topping 14.7 percent in 2014, a full year sooner. That year, according to the Office of Management and Budget, interest owed will total $510 billion versus $3.455 trillion of projected revenue.

When that happens — not if, but when — nobody really knows what will happen, but a market crash will likely occur. The true systemic risk to the U.S. economy is not markets running wild, it is the government. In fact, sovereign default in Greece compelled yesterday’s bear market. Investors were running not wild, but rather away — from government. They fear default like the plague, and so should you.

Bill Wilson is the President of Americans for Limited Government.