In it, they claim that in the U.S. and in Europe, central bank monetary policy is too tight right now, and that it needs to loosen up to move “nominal spending back toward its pre-crisis trend and keeps its future growth stable.”

By “nominal spending,” Ponnuru and Beckworth are referring to the Nominal Gross Domestic Product (NGDP), which is simply the current dollar value of the economy. They claim that in the U.S., “It would be reasonable to set [the] growth rate at 5 percent a year, in keeping with the pattern of the economically stable quarter century prior to the crisis.”

Ponnuru and Beckworth suggest the Federal Reserve “could do this by committing to buy up as many securities as needed to hit its target” on a conditional basis to meet an explicit 5 percent or above NGDP growth target. They note because nominal spending is still below the pre-crisis trend the “Fed would for some time have to accommodate nominal-income growth above 5 percent annually to shrink the gap”.

Magic money beans

Ponnuru and Beckworth claim that by merely announcing this step, markets would react positively, “reducing the need for the Fed to purchase more assets.” Moreover, with the supposed boost in confidence, they state that the Fed’s balance sheet “would not have to expand as rapidly as it has over the past few years.”

So, after the National Review Federal Reserve Board unveils its Soviet-style Gosplan, apparently everyone will have a party, and their promised magic money beans will never even need to be fully planted for the economy to once again start growing robustly.

Gosh, why didn’t Fed head Ben Bernanke think of that one? Here he was sitting around telling everyone exactly how much he would be buying of toxic mortgage and sovereign debt assets that nobody else wanted rather than waving a magic wand and keeping the total purchase amounts to himself, thus presumably moving “nominal spending back toward its pre-crisis trend and keep[ing] its future growth stable.”

Apparently, Bernanke’s big mistake that caused him to buy so many toxic assets was stating the $1.25 trillion purchase number, and honestly admitting it was to “reduce the cost and increase the availability of credit for the purchase of houses.”

Too bad for Ben. Who knows how much he might have wasted. With just a few magic words and a touch more ambiguity, he could have perhaps saved hundreds of billions of made-up dollars!

And when the Fed announced QE2 — up to $600 billion of treasuries purchases — the Board of Governors apparently should have just left that number blank. And then intoned more magic words, saying the purchase would “promote a faster recovery … and firmly anchor long-run inflation expectations”. Instead, the Board said it was to “[t]o promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate”.

Oh wait. Isn’t that the same thing? Never mind.

Are you taking notes over there at the Eccles Building, Ben?

The numbers don’t lie

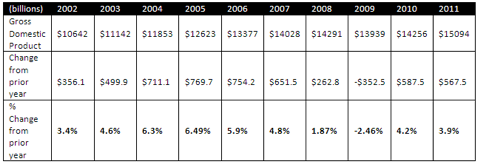

But let’s try a more serious approach to analyzing Ponnuru and Beckworth. First, let’s look at some numbers. Here follows the Gross Domestic Product courtesy of the Bureau of Economic Analysis for the past decade. The bottom row shows the nominal, percent changes in NGDP growth on an annual basis:

In 2003 and 2007, and again in 2010 and 2011, it came close to meeting the target. And in 2002, 2008 and 2009, it fell short. So, in all of those years, per Ponnuru and Beckworth, the Fed should have been filling in the gap on a quantitative basis — but was not, they claim, because monetary policy was too tight.

There is only one problem with this analysis. It is not accurate. In fact, the Fed’s balance sheet expanded over the decade at a rate — through purchases of treasuries and mortgage-backed securities — that meets and exceeds Ponnuru and Beckworth’s call to meet a 5 percent NGDP growth target.

In fact, the Fed’s balance sheet has expanded by $2.22 trillion since the end of 2002. Under NGDP targeting, it would have risen by $1.98 trillion — and that is if the years nominal growth exceeded 5 percent had resulted in a zero-dollar increase in the Fed’s balance sheet.

Or, under a different scenario, NGDP targeting would have resulted in a $1.52 trillion balance sheet expansion, if the excess nominal growth years of 2004 to 2006 had resulted in an actual Fed contraction to meet the arbitrary 5 percent target.

But Ponnuru and Beckworth likely wouldn’t have suggested a quantitative tightening during those years — because those were the years they say that monetary policy was too “tight”.

Either way, the target was more than met. See for yourself. Note: The “needed Fed injection to meet NGDP target of 5 percent” is the shortfall between a 5 percent nominal growth rate and the actual growth rate for that year, assuming a dollar of growth for every dollar of assets the Fed purchases.

Very clearly, the Fed has hit the amount of asset purchases that would have been needed to increase nominal spending to 5 percent. Specifically, it exceeded those targets from 2003 through 2008, and in 2010 and 2011.

Only in two years was the target not met, 2002 and 2009, but that did not result in an economic contraction the following year. In fact, the exact opposite occurred. In 2004 and 2010, NGDP grew rapidly at 4.6 and 4.2 percent.

Importantly, even when the target was missed, it was more than offset by ample increases in the Fed’s balance sheet in all of the other years. So, tell us another one.

Now what?

This leaves us back where we started, more or less. The Fed met Ponnuru and Beckworth’s target, and still the economy is in its current state. Unemployment is still above 8 percent. Real growth an anemic 1.8 percent in 2011 once adjusted for inflation, and now we’re slowing down once again.

Perhaps one could argue that because the Fed did not say it was supposed to be hitting such a target, that the target did not fail. But surely markets have been pricing in the Fed’s asset purchases all along, as its H.4.1. release is updated on a weekly basis. Mere semantics or ambiguity about the size of its asset purchases would not have restored market confidence.

Another conceivable counterpoint is that the Fed did not purchase enough assets. Although, one misses that nuance in Ponnuru and Beckworth’s article, who failed to warn readers their target is anything other than a dollar-to-dollar conversion from asset purchases into NGDP growth.

Or perhaps one might say the Fed didn’t purchase the “right” assets. That it should have been buying equity or corporate debt. Or maybe even directly purchasing goods and services.

I know. They could have been purchasing hundreds of billions copies of the National Review to boost aggregate demand. But does anyone believe that would have saved the economy?

Standing athwart history?

Because, after this episode, it is hard to believe any self-proclaimed conservatives would want a thing to do with the National Review, if this is the sort of tripe they print. It is an appalling joke to call this “conservative”. Instead of standing athwart history, yelling Stop, it is promoting the dangerous idea that a printing press will lead us to prosperity.

This idea could put the already powerful Fed into the complete driver’s seat of the economy, picking winners and losers, filling in the gaps of aggregate demand wherever it chooses. It also puts the National Review in the same camp as Paul Krugman, who too supports NGDP targeting.

Only, the New York Times columnist and economist was far more explicit (and honest) about the inflationary goal of the plan, writing, “the basic point is that to gain traction in a liquidity trap you must either engage in huge quantitative easing, raise the expected rate of inflation, or both. Yet saying this is very hard; people treat expansion of the Fed’s balance sheet as horrible money-printing, and as for the virtues of inflation, well, wear your body armor.”

Krugman continues, “But say that we need to reverse the obvious shortfall in nominal GDP, and you’ve found a more acceptable way to justify huge quantitative easing and a de facto higher inflation target. Don’t call it a deception, call it a communications strategy. And as I said, I’m for it.”

So, there you have it. The National Review has joined forces with Paul Krugman, calling for limitless quantitative easing to print our way to prosperity.

Of course, one unintended but natural outcome of Ponnuru and Beckworth’s proposal could be that the Fed winds up buying equity and corporate debt, essentially printing money to take ownership of the private means of production in the U.S.

Are we all socialists now? Although that may not be the outcome Ponnuru and Beckworth intend, when they urge the Fed to “buy up as many securities as needed to hit its target”, as the saying goes, be careful what you wish for.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.