They also make further quantitative easing, i.e. money-printing, by the Federal Reserve that much more likely should another crisis be touched off. These are the land mines in the way, and they are just some of the ones we know about.

First off, with the worsening crisis over Iran’s nuclear brinksmanship, the situation could explode any day, with Israel, the U.S., or Iran itself taking some form of military action touching off a wider regional war.

That would be bad enough, but economically, the impact would be felt by placing significant price pressure on oil, sucking more cash out of the economy at a time when all charts are already pointed downward.

Next, the fiscal year is coming to an end on Sep. 30, and leaders in Washington, D.C. are nowhere near an agreement that would fund the government for the 2013 fiscal year. There is talk of a stopgap measure that would keep things funded through the end of the calendar year, but that will just add to the year-end difficulties — when the current tax rates are set to increase and the debt ceiling will most certainly have been reached.

Nonetheless, the threat of a government shutdown in Oct. is real enough should the House and Senate prove unable to work out their differences, and then again in Dec. This could put more pressure on our credit rating or spook foreign creditors.

With China’s economic slowdown taking root, that country may be reaching its limit of how much exposure to U.S. treasuries it can afford to take on as its holdings have not increased in a year.

That’s not a good sign. With the U.S. national debt of $15.8 trillion set to soar to $25 trillion by 2022, where will we borrow our next $10 trillion of debt from? An already-overleveraged financial system? The Federal Reserve? Looking overseas for a bailout in the midst of a significant global downturn may be a fool’s gamble.

Moreover, troubled countries in Europe, particularly Spain and Italy but also Greece, have a series of bond auctions and payments coming due that could cause more problems as policymakers scramble to secure more funds to refinance and expand their insurmountable debts. A failure to meet those obligations could touch off a Lehman-style event, causing bank failures, risking another financial collapse — with taxpayers left holding the bag.

Adding to the uncertainty, the German constitutional court is set to rule on Sep. 12 on whether the €700 bil. European Stability Mechanism violates Germany’s sovereignty. An unfavorable ruling could void the entire European bailout regime, leaving Portugal, Italy, Ireland, Greece, and Spain (PIIGS) without a ready means of making payments.

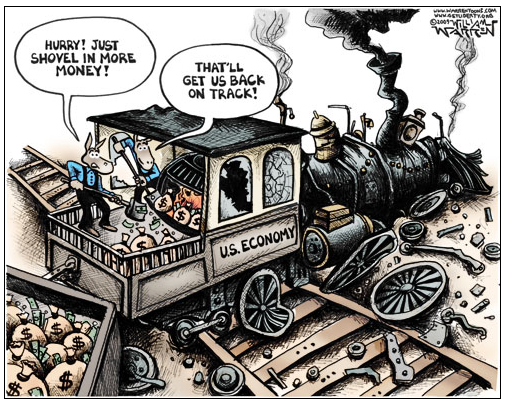

Meanwhile, the only solution Keynesians like New York Times columnist Paul Krugman see are to just print more money to refinance and expand the debts, to keep interest rates low, and fuel inflation. What benefit has been or will be derived though?

Everyone already knows that the sovereign debt Ponzi game is rigged. That interest rates are bogus and contrived — on treasuries as well as the Federal Funds Rate offered by the Fed. That is why Wall Street yawned at the Barclays Libor/interbank lending rate rigging scandal. They have not offered a market-based price signal for years.

If the already-easy monetary policies of the Fed, Bank of Japan, Bank of England, and others cannot revive this economy — in short if credit is still not expanding after more than tripling the monetary base after four years — there is little reason to believe that further easing ala QE3 will do anything to help.

Not when all of the excess leverage is the problem, with over $54 trillion of combined credit nationwide. Instead of more easing, the Fed needs to eat the leverage out of the system by hiking rates up and cutting off its emergency lending programs. Any institution that cannot afford to pay its debts would be liquidated.

Final capitulation in the markets — which is actually needed — will only come when the Fed returns the economy to fundamental, rules-based principles, chief of which is that if you cannot pay your debts, you fail. No more bailouts.

This would cause significant pain in the short-term, but the economy would be able to find the real price for money again. There would likely be a severe recession, albeit a short-lived one, as well as a temporary spike in unemployment while excess credit was removed.

It would be harder to allocate credit at first, but there is enough capital on the sidelines that new creditors and banks would emerge to purchase existing financial assets at a discount, with new arrangements for payment worked out with debtors.

The U.S. would not be able to borrow at such low rates, and would be forced to balance its budget, probably along the lines as proposed by Senator Tom Coburn in his “Back in Black” plan to cut $9 trillion from the budget over ten years.

Of course, none of that is likely to happen without new leadership in Washington, D.C. We already know what Barack Obama will do, which is just borrow and print more money into perpetuity, postponing the inevitable crisis (and making it worse).

Less clear is what Mitt Romney might do. Is he like Ronald Reagan, who in his first years in office courageously ate a harsh recession to kill off the 1970’s inflation? Or, will he pursue a watered-down Obama spending deluge, in the hopes of a miracle?

Let us hope Romney channels Reagan, because any other course would be based on nothing more than hope and a prayer and is virtually certain to lead to a further steep economic decline.

Bill Wilson is the President of Americans for Limited Government.