Often times Congress does not get praised when members do the hard work on behalf of the American people to protect their interests. The House Financial Services appropriations bill is one such notable bill that you will hear almost nothing about.

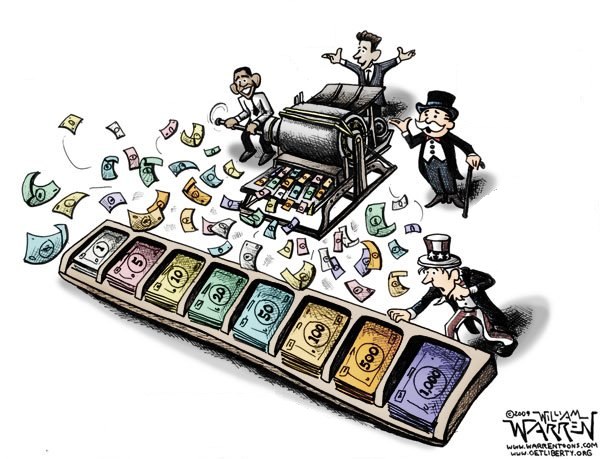

The House Financial Services bill is an Article I bill. It will defund the Consumer Financial Protection Bureau (CFPB) from getting printing press money from the Federal Reserve. The background here is that the Bureau is getting about $490 million a year from the nation’s central bank.

That is, without any votes in Congress, an agency inside the Fed with vast rulemaking powers into the nation’s economy is self-funding — with money from a printing press. Defunding this unconstitutionally funded agency and subjecting it to traditional appropriations is a good first step.

As background, it should be noted that the Federal Reserve as a whole is self-funding including the CFPB, according to the central bank’s website: “Operating expenses of the Reserve Banks, net of amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled $3.9 billion in 2015. In addition, the Reserve Banks were assessed $689 million for the costs related to producing, issuing, and retiring currency, $705 million for Board expenditures, and $490 million to fund the operations of the Consumer Financial Protection Bureau.”

That includes employee expenses, which similarly come out of the printing press, which with maximum pay at $242,500 a year at the high end is about 18 percent more than what even Cabinet secretaries can receive and about 33 percent more than what regular federal bureaucrats receive including most political appointees.

CFPB employees can get even more than that, with maximum pay at $259,500 — making them among the highest paid employees in the federal government (even more than the Chief Justice of the Supreme Court) and second only to the President himself who makes $400,000 a year. On top of that, because the defined benefit retirement plans at the Federal Reserve are based on pay scale in the formula, pensions too would be well in excess of what typical federal government employees receive.

All at the discretion of the Fed’s Board of Governors, pursuant to Section 10 of the Federal Reserve Act: “The Board shall determine and prescribe the manner in which its obligations shall be incurred and its disbursements and expenses allowed and paid, and may leave on deposit in the Federal Reserve banks the proceeds of assessments levied upon them to defray its estimated expenses and the salaries of its members and employees, whose employment, compensation, leave, and expenses shall be governed solely by the provisions of this Act, specific amendments thereof, and rules and regulations of the Board not inconsistent therewith; and funds derived from such assessments shall not be construed to be Government funds or appropriated moneys.”

And Federal Reserve employees are not even technically government employees — with the exceptions of the Fed’s Board of Governors, and the head of the CFPB, who are Senate-confirmed and are government employees and subject to a different pay scale — even though they’re issuing government regulations. As noted on the Richmond Fed’s website, “Employees of the Federal Reserve Banks are not government employees. They are paid as part of the expenses of their employing Reserve Bank.”

“Expenses,” indeed. More like, “We printed $3.9 billion to pay ourselves and set our own pay scales and pay out platinum defined benefit pension plans.” Since the rules for pay and pensions are set solely at the Board’s discretion and beyond the purview of Congress, the courts and even the President, it appears to be rife for abuse.

But, with the House legislation defunding the CFPB’s printing press money, that may be beginning to come to an end.

In a statement praising the legislation, Americans for Limited Government President Rick Manning stated, “It will end the individual mandate under Obamacare, defend churches against IRS abuses. It will defund certain Treasury regulations regarding investments in overseas coal-fired plants. It will prohibit the Financial Stability Board from taking over and bailing out financial institutions under Dodd-Frank. It cuts off any funding for the Cuban military and intelligence. It defunds Net Neutrality. And it even comes in $1.5 billion under the previous year’s appropriations level.”

Manning added, “The Financial Services appropriations subcommittee led by Chairman Ander Crenshaw should be very proud of their work shown by their determination to not allow President Obama’s abuses of power to remain unchecked. Americans for Limited Government strongly urges the passage of this legislation through the Rules Committee, the House of Representatives and Congress as a whole.”

Manning also urged action on an amendment by U.S. Reps. Sean Duffy and Tom Marino that would decrease funding to the Community Development Financial Institutions (CDFI) account at the Department of Justice to offset $20.7 in illegal monies from legal settlements; an amendment by U.S. Rep. Ken Buck that would eliminate the salary of the IRS Commissioner who is currently under consideration for impeachment after lying to Congress; and U.S. Rep. Paul Gosar who has an amendment to deny IRS employees bonuses given complicity in the targeting scandal against the tea party and other non-profit groups.

This is the way the power of the purse is supposed to operate, Manning said, concluding, “Using the Congressional power of the purse to limit the executive branch is exactly what the Framers intended when they implemented the separation of powers.” Action on the bill is expected after the July 4 holiday.

Robert Romano is the senior editor of Americans for Limited Government.