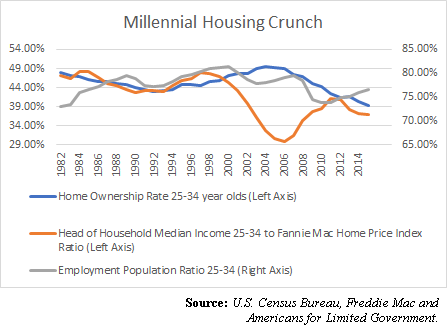

The home ownership rate among 25 to 34 year olds peaked in 2004 at 49.5 percent and then plummeted when the housing bubble collapsed, to 39.2 percent in 2015, according to data compiled by the U.S. Census Bureau. It still has not stopped dropping.

The cause? Apparently, the gap between incomes and home prices, if a comparison of Census and Freddie Mac data are to be believed.

Starting in the 2000s, as home prices were rising, incomes for 25 to 34 year olds did not keep up — even as home ownership among 25 to 34 year olds was still rising — until the affordability gap ultimately dragged the ability for 25 to 34 year olds to own a home.

The head of household median income to Freddie Mac Home Price Index ratio charted well with home ownership rates for 25 to 34 year olds until about the year 1998. Then the two diverged all the way until the housing collapse, with the income to home price ratio dropping from 48 percent in 1998 down to 30 percent in 2006.

Now the affordability gap is approaching levels seen in 2002 and 2003 (and still dropping), and younger Americans increasingly are steering clear of the U.S. housing market and from the dream of home ownership. If you were lucky and bought in say 2010 or 2011 then you caught that once in a generation (some would say once in a century) market bottom, then it’s far more likely your mortgage payment is less than the current rent prices seen today.

Unfortunately, that was the point in the downturn when unemployment was essentially at its peak and incomes were flat, so the opportunity to take advantage of that bottom in regions that track national indices was narrow indeed.

Since then home values have once again far outpaced income growth, and so the dream is now that much further away for Millennials. It’s only a problem if you believe every generation should be better off than the preceding one. Whether they could get help from their parents while they were still around will wind up probably being the lesser of problems faced by Millennials. Saving for retirement will be even a potentially bigger problem for them if equities take another hit ala 2000 and 2008.

The real crunch could come as Baby Boomers look to downsize their homes for retirement and find that the potential pool of Millennial homebuyers for larger homes is smaller than anticipated. That could cause prices to fall in those neighborhoods, creating some buying opportunities for those currently living in starter homes to upgrade. But if you never got into a starter home to begin with, then that ship might sail too.

Like so many other problems, the solution is growth economically, which tracks with income growth, which, in turn, could support things like home purchases. Unfortunately, the past 10 years were the worst on record for economic growth — even worse than 1930-1939, according to data compiled by the Bureau of Economic Analysis.

If Washington, D.C. in GOP control proves to be impotent in implementing a pro-growth agenda, if the current policies being pursued do not create the growth of GDP, jobs and income we all hope and pray for, my guess is the political pendulum will swing dramatically in the opposite direction, and the push for things like guaranteed income will onset rapidly and change America irrevocably.

Fertility is certainly a factor to consider. To the extent that couples forego having children nowadays, fertility in the U.S. has been below 2 babies per woman since 2010 and still dropping, according to the World Bank, that removes an incentive to upgrade living conditions into a home. If you don’t need the extra space, why buy a home?

Of course, the decision to not have children appears tied to the economic downturn as well. If you don’t feel secure in your career and income, you are less likely to settle down and have kids.

Individually, these types of factors impact lifestyle and career choices, but those choices are not the cause, they are the symptom. It’s not that Millennials decided, suddenly, to stop buying homes. What appears to be a late-blooming effect for Millennials is not a matter of preference, it appears to be a matter of affordability. The growth of the costs of housing, education, etc. far exceeding the growth of income is the root cause.

Eventually lower rates of working, marriage, and fertility, plus slower growth in incomes, in the aggregate are going to affect rates of home ownership, the ability to retire, etc.

So, the solution are policies that foster growth. Economic growth. Job growth. And income growth. Lowering the cost of doing business. Locally, there are functions for government to fill as well, by not forbidding new construction in areas of high demand. Nationally, policies like Affirmatively Furthering Fair Housing should be defunded, the goal of which appears to be to further boost central urban property values.

Overall, the lack of income growth and robust job creation while housing prices keep rising is creating an unaffordable housing situation for younger Americans — leaving the American dream of home ownership beyond reach. If jobs and incomes do not catch up and prices keep rising, we could eventually find ourselves in another housing downturn.

Robert Romano is the senior editor of Americans for Limited Government.