The danger of the Covid relief checks is that they will become permanent — a perverse incentive not to work.

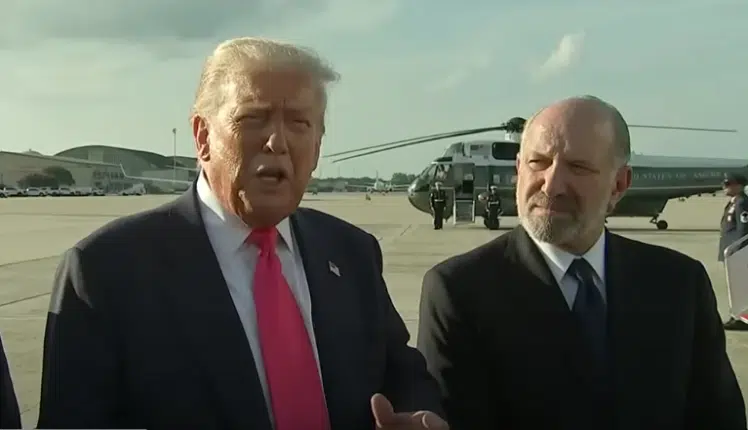

The House has voted to expand direct payments to the American people from $600 per adult and $600 per child in the year-end Covid relief legislation signed into law by President Donald Trump, to $2,000 per adult and $600 per child, a move the President supports.

Under the newly signed law, an average family of four will be receiving a $2,400 check via direct deposit from the U.S. Treasury, coming atop the $3,400 they received in the CARES Act in the spring — a combined $5,800 in 2020 alone.

The push now would take that number up to $5,200 for the hypothetical family of four, or a total of $8,600 from the Covid relief bills, but the legislation seems to have no pathway in the Senate.

The original CARES Act was passed as 25 million Americans were losing their jobs to the state-led Covid economic lockdowns, including $525 billion for small businesses, $500 billion for critical industries, cities and states, $500 billion of additional checks to households, $130 billion for hospitals to fight the outbreak, an additional $150 billion for state and local governments akin to the Obama stimulus of a decade ago, an additional $50 billion employee retention tax credit for companies, and the rest was a massive expansion of unemployment benefits that amounted to paid sick leave for every person who lost their jobs when the virus struck.

In particular, the small business relief supported 5.2 million small businesses and saved about 50 million jobs is credited with the rapid economic recovery with massive growth in the third quarter and 16.4 million recovered out of the 25 million jobs lost when labor markets bottomed in April.

Now, under the new law, there is a $280 billion renewal of the Paycheck Protection Program that saved as many as 5.2 million small businesses and 50 million jobs last spring. Another $16 billion for airlines and critical industries, another round of $600 checks plus a $600 child tax credit, and an extension of unemployment benefits with a $300-addon to regular benefits are also included.

Into the mix, President Trump will be requesting a number of rescissions from the annual budget that were included in the Covid legislation. In a statement from the White House, President Trump said, “I will send back to Congress a redlined version, item by item, accompanied by the formal rescission request to Congress insisting that those funds be removed from the bill. I am signing this bill to restore unemployment benefits, stop evictions, provide rental assistance, add money for PPP [Paycheck Protection Program for small businesses], return our airline workers back to work, add substantially more money for vaccine distribution, and much more.”

Once the rescissions are back to Congress, both chambers would have 45 days of continuous session to act on them. But the current session will end on Jan. 3. So, the rescissions most probably won’t be acted upon.

The question of financial assistance via direct payments, in the midst of the pandemic, is the question of reopening—and when can the American people expect life to go back to normal?

That is why the focus must be on reopening America and states as the number of cases begins declining. Which on that count, we may be turning the corner.

Confirmed new Covid cases daily has been dropping since mid-December, according to official data, as the vaccine was released, from 280,000 on Dec. 11 down to 218,000 on Dec. 26. This mirrors projections from the Institute for Health Metrics and Evaluation, showing probable daily new cases peaked on Dec. 23 at 695,000 down to 646,000 on Dec. 28 and an expected decline in cases through the rest of winter.

As Americans for Limited Government President Rick Manning noted in a statement, “With the vaccine being distributed, the federal and state governments need to be planning reopening strategies, and any additional stimulus should be directed to ensuring that people get back to work, rather than bailing out governments or pretending there’s a money tree sitting outside the Capitol.”

Manning added, “In the future it may be necessary to support industries and small businesses that continue to be negatively impacted by state government economic lockdowns, however the impulse to send everybody another check whether for $2,000 or any other amount should be resisted the same way that taking another hit on a highly addictive drug should be. It may feel good when you do it, but it’s bad for you and everyone knows it.”

Manning is right. When it comes to reopening, the incentive has to be to go back to work. The dilemma is there needs to be work left to come back to.

The danger of the Covid relief checks is that they will become permanent — a perverse incentive not to work.

That is why Congress will need to be vigilant in 2021, to ensure that the current relief monies are not turned into universal income. With 9 million Americans still on the sidelines after losing their jobs earlier this year, that would be a catastrophe and result in another lost generation of opportunity akin to the first Obama-Biden administration.

You can have work, or you can have universal income, but we will not have both. It’s time to get back to work.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.