The U.S. Federal Reserve once again hiked its core interest rate, the Federal Funds Rate, by another 0.5 percent to 4.25 percent to 4.5 percent amid continued high prices even as inflation has cooled somewhat the past five months, as the central bank downgraded its 2023 economic forecast on both growth and labor markets.

In its release, the Fed stated, “Russia’s war against Ukraine is causing tremendous human and economic hardship. The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.”

The Board of Governors projected the Gross Domestic Product to be in a range from -0.5 percent to 1.0 percent. According to the Fed’s release, “The range for a variable in a given year includes all participants’ projections, from lowest to highest…”

In September, though, the Fed was slightly more bullish on the economy in 2023, when it projected a range between -0.3 percent to 1.9 percent. The downgrade in the outlook means that the picture ahead must be gloomier than initially thought.

The Fed also projects that it will continue hiking interest rates into 2023, with an expected range of 5.1 percent to 5.4 percent. That is up from its September projection of 4.4 percent to 4.9 percent. The outlook comes amid a slight increase in inflation expectations by the central bank from its September outlook even as it projects inflation to keep cooling in 2023.

Another factor to consider is what impact the higher interest rates—30-year mortgages are going for about 6.3 percent now—will have on destroying some of the $6 trillion that was borrowed and printed into existence by Congress and the Fed in 2020 and 2021, dramatically increasing the M2 money supply, which peaked at $22 trillion in April 2022 and is now down to $21.3 trillion now.

As for labor markets, the central bank is projecting an unemployment rate between 4 percent and 5.3 percent. With the civilian labor force about 164.5 million at the moment and the unemployment rate currently at 3.7 percent, the implication is that there are anywhere between 493,000 to 2.6 million more jobs losses that will come in the Bureau of Labor Statistics’ household survey over the next year.

That would come atop 466,000 fewer Americans saying they have jobs in the past two household surveys, potentially bringing the jobs losses in the current imminent recession to anywhere between 959,000 and 3 million jobs lost.

That would make this a somewhat below average recession, particular to the unemployment rate and especially compared to the last two recessions, which were above average. For example, during the 2020 Covid recession, the unemployment rate got as high as 14.7 percent in April 2020. And in Oct. 2009, it hit 10 percent.

And a good deal of that could have to do with the aging demographics labor markets are currently undergoing, with millions of Baby Boomers leaving the labor force, which has led to labor shortages — and some thought that those shortages will have the impact of the unemployment rate being on average lower than normal.

Similar demographic issues in countries like Japan — which is much further along than the U.S. in terms of declining fertility and demographic decline — found its unemployment rate only rise to 3.2 percent in the 2020 Covid recession and 5.7 percent in July 2009 after the financial crisis.

With fewer workers to hire, firms on the margins might be less willing to engage in layoffs for fear that they might not be able to replace that talent after the recession. Nonetheless, the Fed expects those recessionary forces to still come into play, weighing on labor markets throughout 2023 as the unemployment rate almost certainly will rise.

The question is by how much.

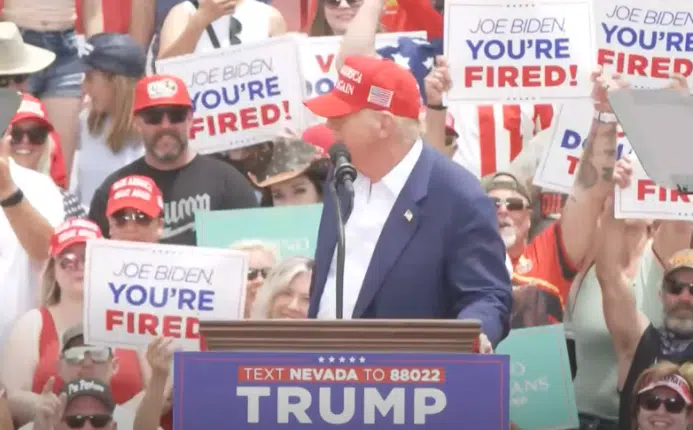

How bad it is might have a lot of bearing on the 2024 presidential election cycle, with President Joe Biden expected to seek reelection. If he does, his chances of winning will undoubtedly be impacted by the health of the economy. Just ask Herbert Hoover, Gerald Ford, Jimmy Carter, George H.W. Bush and Donald Trump, who all had recessions come too close to their bids for second terms, and who all lost. As usual, stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.