Consumer prices experienced a 0.3 percent increase in the December amid jumps in electricity, shelter and medical care services, growing at 3.4 percent rate over 12 months, according to the latest data from the Bureau of Labor Statistics, while producer prices cooled off for the third month in a row amid major drops in food and energy costs.

Electricity for consumers was up 1.3 percent, following a 1.4 percent increase in November.

Shelter was up another 0.5 percent, following a 0.4 percent increase in November.

And medical care services were up 0.7 percent, following a 0.6 percent increase in November.

On the producer side, the cost of foods dropped 0.9 percent.

Energy was down 1.2 percent, following a 2.4 percent drop in November.

And transportation and warehousing was down 0.4 percent, following a 0.2 percent drop in November.

Since consumer prices are downstream from producer prices, the drops in producer costs — which are down to a 2.5 percent rate over 12 months — are likely a good sign that the price increases are headed for the rear-view mirror.

The downside is that this may also reflect demand ultimately cooling off following the economy overheating with inflation in 2021 and 2022. Eventually, households max out their credit and demand slows as the business cycle comes to an end. Then, layoffs and firings ensue and the unemployment rate goes up.

As it is, the Federal Reserve is projecting unemployment to rise from its current level to 4.1 percent this year. That’s an implied 650,000 jobs lost or so from the current level in the household survey, give or take.

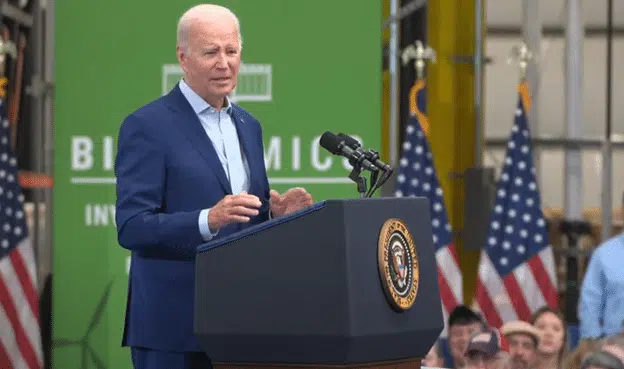

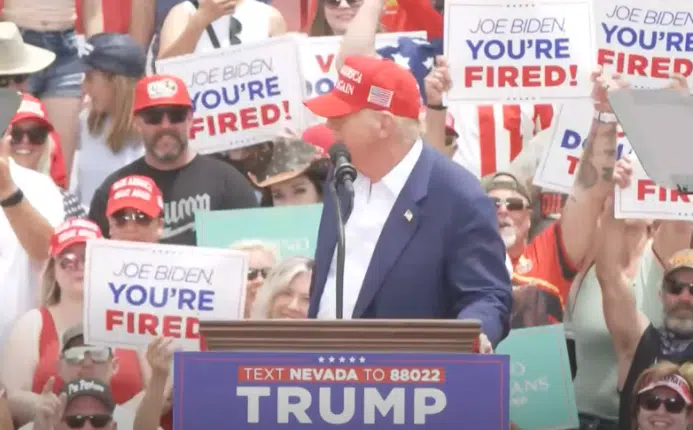

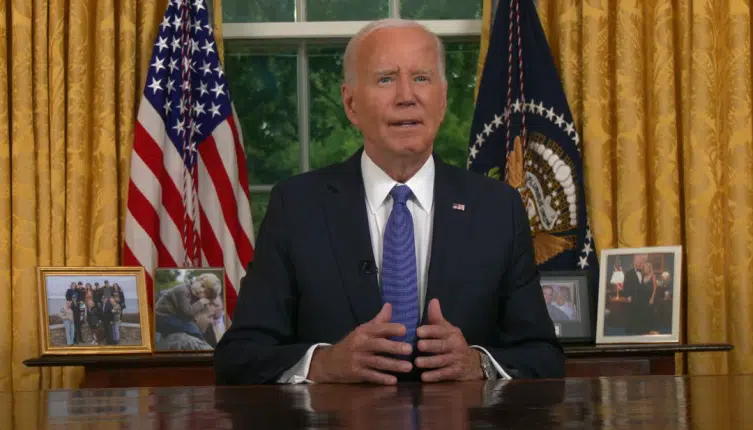

Whether that results in a recession or merely an economic slowdown — labor markets are being offset by the major retirement wave underway by Baby Boomers — might matter less than if households who have definitely felt the pinch as inflation outpaced incomes take it out on President Joe Biden in the 2024 presidential race.

Soft landing or no, the damage may have already been done. The question is how much fallout will occur in labor markets. Stay tune.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.