10.10.2023

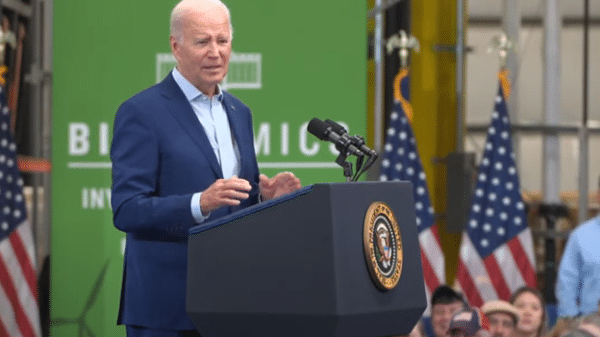

By Robert Romano Consumer and Republican backlash against Environmental, Social and Governance (ESG) investments has increased dramatically in the past year as states, Congress and presidential candidates have taken on the issue, promising to rein in the largely green-conscious movement of capital amid spiraling energy and food costs since […]

10.09.2023

By Robert Romano Labor markets appeared buoyed by still-working Baby Boomers in September as the unemployment rate remained unchanged at 3.8 percent , with 296,000 seniors finding jobs in the Bureau of Labor Statistics’ household survey. With more than 11.1 million seniors still working — a national record — peak employment still abounds, even as a massive 47.21 million seniors are no longer in the labor force — also a record — amid the […]

10.02.2023

By Robert Romano Sept. 30 has come and gone as fiscal year 2023 has ended, but without an agreement from Congress on appropriations for the $1.7 trillion so-called “discretionary” budget, resulting in a 45-day continuing resolution that will continue to fund the government at 2023 levels, give or take, until Congress […]

09.27.2023

By Rick Manning The professional point-missers in official Washington, D.C. are focused this week upon the supposed “looming government shutdown” declaring apocalyptic doom to anyone who will listen. Fortunately, those who take these prognosticators of the status quo seriously are becoming few and far between. A […]

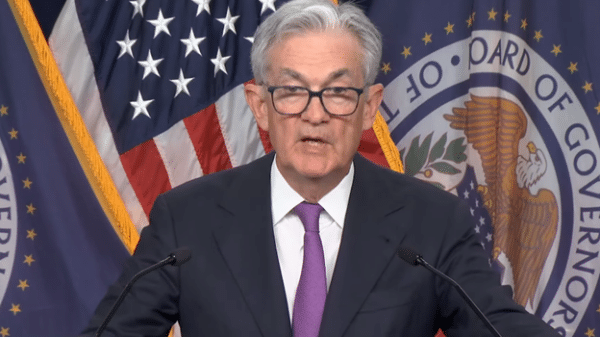

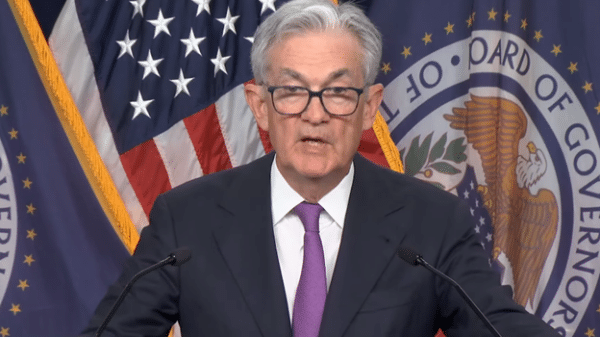

09.21.2023

By Robert Romano The Federal Reserve on Sept. 20 held the federal funds rate steady at 5.25 percent to 5.5 percent amid inflation jumping in August to 3.7 percent annualized from 3.2 percent in July, stating that “[i]n determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into […]

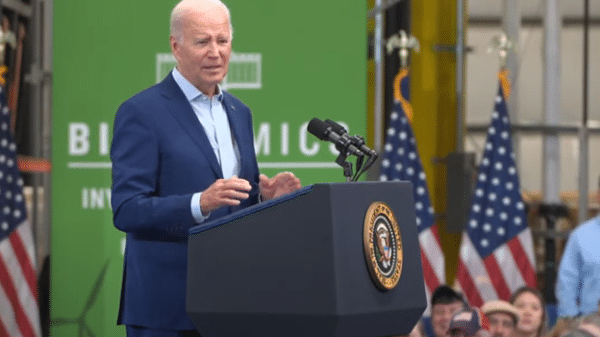

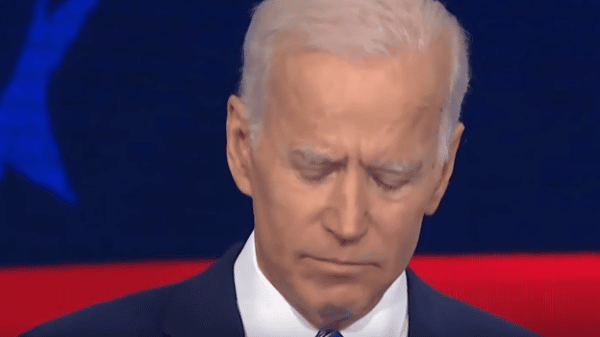

09.14.2023

By Robert Romano It is no mystery that the core demographics for the Democratic Party include single women, blacks and Hispanics. In 2020, Biden won unmarried women 63 percent to 36 percent over former President Donald Trump, blacks 87 percent to 12 percent and Latinos 65 percent […]

09.14.2023

By Robert Romano Household median income took a major hit in 2022, dropping 2.3 percent to $74,580, amid high inflation that peaked at 9.1 percent annualized in June 2022, according to the latest figures from the U.S. Census Bureau . The news comes as inflation is once again heating up in the U.S. economy, with consumer prices rising 3.7 percent annualized in August according to […]

09.11.2023

By Robert Romano Declining fertility in advanced economies is nothing new. Since birth control was approved by the Food and Drug Administration in 1960, at the same time more women were entering the labor force and attending higher education, amid higher inflation, greater unemployment and a weaker […]

09.04.2023

By Rick Manning What is the state of the labor force in America on Labor Day 2023? It is transitioning. More and more employers who were previously embracing the work from home model are now demanding that employees come back to the office, and employees who like […]

09.01.2023

By Robert Romano The national unemployment rate reported by the Bureau of Labor Statistics jumped from 3.5 percent to 3.8 percent in August as an additional 514,000 Americans said they could not find work in the Bureau’s household survey. Now 6.3 million Americans are said to be unemployed, the highest in more than […]