(Correction: A previous version of this article cited an Obama speech on Jan. 7 being on CEO pay. It was actually on the proposed unemployment benefits extension.)

So long as there is money, there will be an economy composed of relatively free individuals making individual decisions about how to spend their money. As a result of this freedom to choose how to spend money, some people will make more money than others. It’s inevitable.

In short, there will always be income inequality. No matter what. There’s no stopping it. So long as there is money changing hands, equality of outcomes will simply be impossible.

As you shortly consider the utility of having money in your pocket or a debit card in your wallet to purchase goods and services you need on a daily basis, next consider Barack Obama and the left’s latest screeds against income inequality.

In a Dec. 4 speech, Obama railed against what he called “a dangerous and growing inequality and lack of upward mobility that has jeopardized middle-class America’s basic bargain.”

First, let us take up his basic premise. Are the rich getting richer?

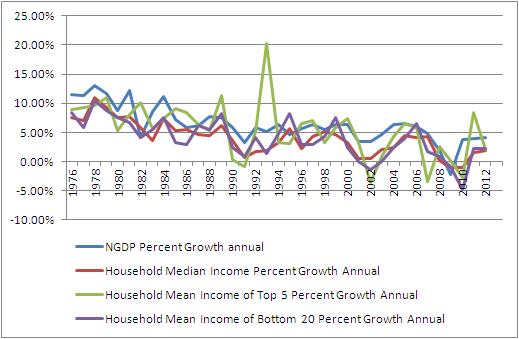

Yes, they are. According to data compiled by the U.S. Census Bureau, household mean income for the top 5 percent of income-earners has averaged 5.43 percent growth annually since 1976. That was above the 4.02 percent average annual growth of household median income, and also above the 3.94 percent yearly growth of the bottom 20 percent’s income.

But is this “dangerous,” as Obama suggests? And is it somehow jeopardizing the existence of the middle class?

The answer to both questions is decidedly no.

First off, the growth of income for top earners has always outpaced those lower on the scale since the U.S. Census Bureau has recorded the data. Therefore, the gap between the rich and poor is always “growing.”

Secondly, the growth of income for top earners has not outpaced nominal economic growth over time. The economy, before adjusting for inflation, has grown on average 6.34 percent every year since 1976. (Note: The reason to look at the non-inflation-adjusted numbers in this instance is because the income levels observed in the data set are not inflation-adjusted.)

What emerges is a flattening of income growth down the ladder that looks more like a natural law of economics than it does any sort manipulation or theft. In order to look at all of the data and conclude otherwise, one would have to believe that the system was somehow inherently rigged or unfair.

Yet, that’s exactly where Obama is. He believes income inequality is unfair and the government must somehow correct it.

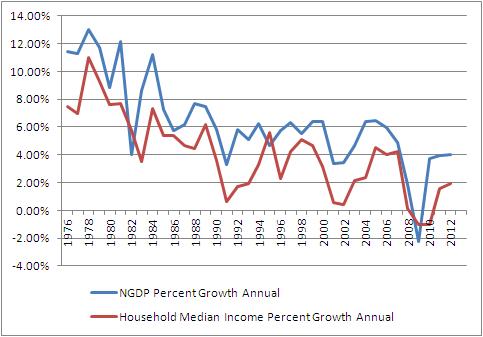

Of course, his approach to the issue is not to, say, figure out perhaps what he might do to increase everyone’s incomes. If so, he would be promoting policies that tend to boost economic growth over time, which by far shows the strongest correlation to incomes over any other indicator.

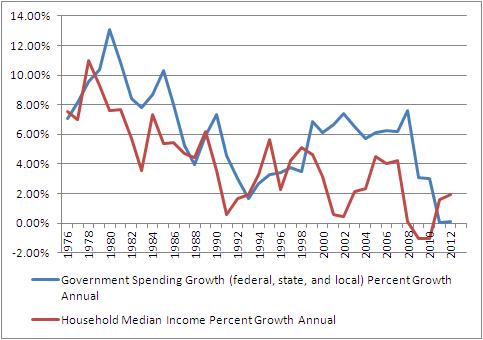

Instead, Obama is narrowly focused on increasing government spending — so-called fiscal “stimulus” — or on what he can do to somehow restrict the incomes of top-earners. Meanwhile, he likely knows full well such measures will do nothing to actually boost wages. By definition, his approach is punitive, and it won’t work.

Moreover, there are many perfectly legitimate reasons why top income earners will tend to fare better economically than everyone else.

First and foremost, by definition, they are the producers that create demand and directly benefit from all economic activity. They are the innovators, those ahead of the curve.

Also, because they make more money, top earners have more money available to take on risk and invest, meaning they have a better chance of keeping up with the nominal growth of the economy.

For those who are born into poorer communities, on the other hand, a deficient public education system, fewer entry level jobs and therefore lack of upward mobility brought on by wage and labor regulations, and high-crime neighborhoods all play roles in perpetuating a cycle of poverty.

The lack of entry level jobs cannot be overstated, particularly, which are being driven overseas by the high cost of doing business here in the U.S. This is driven by high taxes, regulations, labor costs and an unwieldy printing press at the Federal Reserve.

In that sense, if income inequality were a problem, government might deal with it by simply getting out of the way, and figuring out ways to grow the economy.

After all, greater economic growth does tend to show a direct causal link to higher incomes.

Whereas, government spending does not appear to drive wages at all. If anything, it’s the other way around. Higher incomes, resulting in higher tax revenues, seem to have more of an impact on increasing government spending than the inverse.

But, perhaps the American people are not supposed to make any economic sense out of what the President is saying. It need not make sense from a policy perspective, not when it makes perfect sense for him to do so politically.

With the health care law rollout as flawed as it has been, with premiums and deductibles on health insurance increasing substantially, with joblessness still high and labor force participation sinking, and Obama’s credibility on these issues lagging, the White House is desperate to change the subject and shore up its base headed into a tough midterm election cycle of 2014.

Something to keep in mind this year. Obama’s class warfare approach will not help anyone. As far as our economic doldrums are concerned, growth is and always has been the answer.

Robert Romano is the senior editor of Americans for Limited Government.