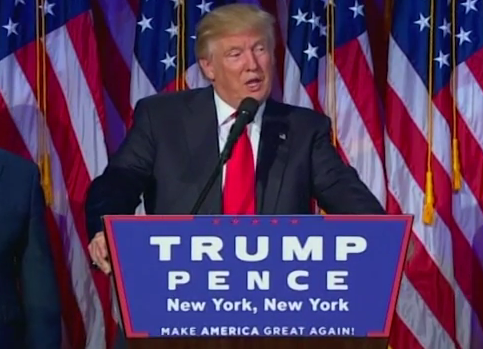

Donald Trump was elected. So, the sky must be falling.

Markets would crash, financial institutions and media had confidently predicted before the election.

Except, that hasn’t happened.

Which is unsurprising to the American people, who have grown accustomed to disregarding warnings issued by biased media outlets that hate their guts. Nothing bad happened after Trump was elected.

Much like Brexit, when where there was no market failure on account of the voters rendering their verdict in the United Kingdom leaving the European Union.

For the record, equities futures were down while votes were being counted on Tuesday, but by the time trading actually began on Wednesday, markets rallied. And then again on Thursday.

So, what the heck was everyone talking about?

Were Citigroup and financial publications just blowing smoke? Inciting fear to help Hillary Clinton get elected, perhaps? What nonsense.

That’s two times in a year, where predictions of financial doom have failed to come true.

Why should anybody listen to these people anymore?

Perhaps the real agenda of financial institutions and media is to simply promote Democratic Party politics under the guise of reporting on economics.

Something to keep in mind as Donald Trump prepares his tax and budget policies, his trade and immigration agenda and other financial industry items.

That is, when the financial institutions and media start hollering about the supposed economic impacts and making dire predictions, warning about trade wars or Smoot-Hawley, you can largely disregard it. It’s just noise.

Take Peter Goodman in the New York Times, warning, “Trump rides a wave of fury that may damage global prosperity,” where he warns, “Tariffs on China might provoke a trade war that could slow economic growth.”

This establishment is like the boy who cried wolf.

If you don’t bail out banks, the markets will crash. So Congress bailed out the banks, and the markets crashed anyway.

If you don’t raise the debt ceiling, the markets will crash.

If Greece leaves the Eurozone, the markets will crash.

If Iceland doesn’t bail out Icesave, the markets will crash.

If the European Central Bank doesn’t bail out Italy and Spain, the markets will crash.

If the global trade agenda is not advanced by adopting the 12-nation Trans-Pacific Partnership (TPP) — the largest trade agreement ever — it will be Smoot-Hawley all over again, tariffs galore and a return to the worst days of the Great Depression.

Now that Trump has been elected, the TPP is dead, and again, nothing bad has happened.

Enough is enough.

Why is the business community and media so darned political? Just tell help us make dollars, cents and make sense of financial developments.

In the meantime, the economy might be due for a major correction or recession soon anyway, we average one every six to seven years and we’re overdue, just based on the business cycle. And given the slow growth of the past decade and a half, thanks to outsourced production, getting things moving again could take a while.

Then the same media will be quick to blame it on Trump — even though the economy has not grown above 4 percent since 2000, and not above 3 percent since 2005 — who just got here and has yet to enact a single policy.

Put growth and jobs into historical perspective. The American people deserve that much. And there is a huge credibility gap with the media right now. They need to cool off a little.

One thing is for certain, nobody should be listening to any more Chicken Little warnings with the intent of lobbying Congress, the administration or anyone else. Markets may ultimately crash one day, but it will be cause of market happenings. Factors you can point to.

In the meantime, just tune out the noise. The media is not fooling anybody anymore.

Robert Romano is the senior editor of Americans for Limited Government.