By Rick Manning

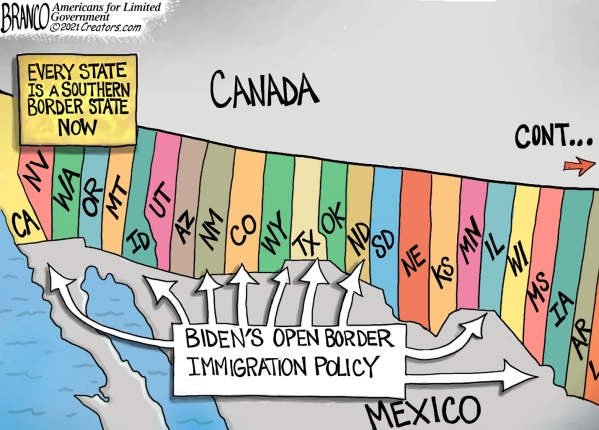

At a time when the U.S. is engaged in high-level trade talks with China and actively considering whether to institute economic sanctions against Beijing, the Federal Retirement Thrift Investment Board is looking at ways to in effect transfer and put at risk $50 billion of federal employees’ retirement benefits by allowing investments in China, in return for nothing.

This not only runs contrary to current U.S. policy, and in effect sabotages the ongoing trade talks, as a former federal employee, I, like 3.3 million other Americans have a part of my retirement funds invested through the Thrift Savings Plan (TSP), which manages over $550 billion in assets.

Let me be clear, the Federal Retirement Thrift Investment Board should not be in the business of offering $50 billion to nations engaged in economic warfare against the U.S.; it is both unpatriotic and fiduciarily unsound.

If anything, not only should the Thrift Savings Plan not be considering Chinese investments at this stage, the U.S. Department of Labor’s Employee Benefits Security Administration ought to be considering whether Chinese investments are suitable for private employee pensions, considering the lack of transparency typical with Chinese-owned and headquartered corporations.

If Chinese companies and corporate bonds cannot be accurately priced and their assets placed under independent audit, the U.S. is in effect leaving it to the benevolence of the Chinese Politburo and state-run enterprises to give the right information, without any assurance that the companies even intend to remain profitable over the long-term when China’s direct economic interests have been satisfied.

Retirement funds have a different responsibility under the law, and Chinese investments do not meet the unique security requirements demanded of retirement funds under the law and the Labor Department should review whether the inclusion of these insecure corporate assets meets the legal investment requirements for private sector pensions.

In addition to regulatory and presidential action that the Trump administration should consider to shore up both federal employee and private retirement funds, U.S. Rep. Jim Banks (R-Ind.) has a very good bill, H.R. 2903, that would block TSP investments in adversaries, barring “investments in any stock of an entity based in a peer or near-peer competitor, including China or Russia.”

This is not a partisan issue. Sens. Marco Rubio (R-Fla.) and Jeanne Shaheen (D-N.H.) had a joint oped on CNBC.com that speaks out against this foolish move by the Federal Retirement Thrift Investment Board.

It is beyond belief that federal employee retirement funds would be put at risk through opening the doors to Chinese-based investments, and the Federal Retirement Thrift Investment Board should reject this bad idea.

Anyone with a passing knowledge of world economic affairs would be aware of the significantly higher risk entailed for U.S. assets invested in China based upon our active reorientation of the U.S. economic relationship with Beijing.

The fact this piece even has to be written is evidence that those trusted with governance of the federal Thrift Savings Plan should be replaced with competent managers who occasionally read the Wall Street Journal.

Rick Manning is the President of Americans for Limited Government.