In May, the Department of Labor Inspector General warned that the new pandemic unemployment assistance program passed by Congress in the $2 trillion CARES Act earlier this year, because of a flimsy self-certification requirement for individuals to receive benefits immediately, “will lead to increased improper payments and fraud.”

Now, between July 25 and Aug. 22, continued claims to this program in the state of California skyrocketed more than 4.4 million before dropping 592,000 to its current 6.4 million level the week of Aug. 29 , according to the latest data compiled by the Department of Labor. Many of the claims covering several weeks as the benefits are being applied retroactively.

California now accounts for 44 percent of all pandemic unemployment claims nationwide, despite only accounting for 15.2 percent of the working age U.S. population.

The surge in claims in California comes as the New York Times reported fraudulent claims in the state where unemployment benefits debit cards were being sent to unattended mailboxes, and Politico similarly reported that genuine recipients were seeing their debit cards drained of benefits before they had the opportunity to use them.

“We do suspect that a big part of the unusual recent rise in P.U.A. claims is linked to fraud,” said Loree Levy, a spokeswoman for the California Employment Development Department in an interview with the New York Times published Sept. 11.

A Department of Labor spokesperson told me that California is reporting the claims on a backdated basis: “California indicated there were a large number of continued claims reported for backdated weeks of PUA. PUA was implemented retroactively for weeks beginning on or after January 27, 2020. In addition, further need to backdate claims occurred due to the difficulties in implementing the new program combined with the extreme claims volumes in both the regular and PUA programs. As a result, individuals that were unable to file for PUA earlier in the period of eligibility and were eligible for backdated claims were filed and reported in bulk by the state as they were taken because CA’s current reporting system is unable to assign the claims to the week to which they applied. This caused continuing claims to appear to be higher than initial claims.”

But as the Department of Labor Inspector General warned in May, these claims are not being verified: “To establish eligibility, the CARES Act requires individuals to self-certify that they have lost employment income due to a COVID-19 related reason specified within the statute. This self-certification renders the individual eligible to receive payments immediately.”

This differs from regular unemployment benefits, which requires states to verify that a person worked before dispensing benefits. Now, with the likely fraud ongoing in California, this critical flaw exposed by the Inspector General is now coming to fruition.

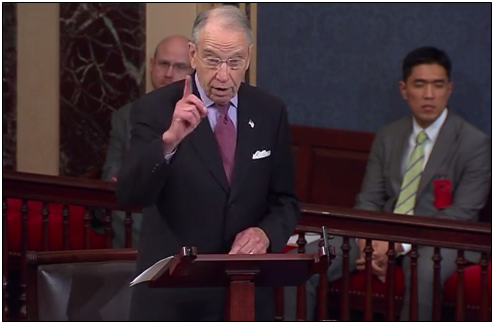

Fortunately, legislation by Sen. Chuck Grassley (R-Iowa), S. 4318, the “American Workers, Families, and Employers Assistance Act,” would rein this provision in and provide for work verification, aligning the program with the same requirements used in the long-standing Disaster Unemployment Assistance.

According to a summary of this provision provided by the Senate Finance Committee, which Grassley chairs, “The CARES Act created the Pandemic Unemployment Assistance (PUA) program, modeled after the long-standing Disaster Unemployment Assistance (DUA) program, to provide support to those not traditionally eligible for state unemployment benefits. Under DUA, applicants can receive benefits immediately, but must provide documentation within 21 days of applying to substantiate prior employment or self-employment (or the planned commencement of employment or self-employment).”

The problem is that documentation requirement for disaster unemployment was not applied by Congress to the pandemic unemployment assistance program: “The Department of Labor has determined this DUA provision does not apply to the PUA program, and this provision requires states to follow the same procedures for verifying eligibility for both programs. This provision would also specify that only those who have lost their principal source of income are eligible for the program, following the same requirement currently in place for the disaster unemployment assistance program.”

Matt Weidinger, Rowe Fellow at the American Enterprise Institute, noted in a July 29 analysis that under the legislation “PUA claimants would be expected to provide proof of prior work and thus their eligibility for PUA benefits within three weeks, or else their benefits would end.”

That would certainly be a step in the right direction, as it would at least create some means for states to limit the possibility of fraud. A legitimate question going forward, given the potential widespread fraud already being seen, is whether the legislation should be strengthened to make the employment documentation requirement a prerequisite.

In the meantime, the Justice Department should work with the Department of Labor to investigate the surge of claims coming out of California that its own state agency responsible for administering the benefits suspects are fraudulent.

For now, the Grassley legislation has been folded into a series of bills being offered by Senate Majority Leader Mitch McConnell (R-Ky.), and this is one provision Republican leaders and the White House need to prioritize in negotiations with the House — or else the California fraud could begin proliferating nationwide.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.

Correction: The CARES Act had a price tag of $2 trillion, not $3.3 trillion as previous reported.