“With inflation well above 2 percent and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month.”

That was Federal Reserve chairman Jerome Powell on March 2 at the House Financial Services Committee, forecasting that the Federal Reserve will indeed begin hiking interest rates at its March 15 and March 16 meetings.

And it’s not a moment too soon — and really, rather late when one considers that inflation has been running hot for almost a year now, coming in at 7.5 percent the past twelve months, according to the Bureau of Labor Statistics plus oil is above $110 barrel now. Did the Fed wait too long?

Being so close to the 2020 Covid recession, the Federal Reserve has left interest rates at near-zero percent throughout the duration of the recovery. Meaning, if a recession were to happen now, the central bank would not be able to assist the economy by moving interest rates any lower.

In short, right now the Fed has little to no room to maneuver if there’s another recession.

That’s important, because right now, the current business cycle appears to be coming to a rapid end and a recession could happen soon, if two separate economic indicators are correct: The Atlanta Federal Reserve’s GDPNow is now projecting 0 percent economic growth in the first quarter of 2022, and the spread between 10-year and 2-year treasuries, a leading recession indicator whose inversions have predicted almost all of the U.S. economic recessions in modern history, has collapsed to just 0.31 percent.

If the 10-year, 2-year spread inverts, a recession tends to result on average 14 months afterwards. Here’s the problem.

And it comes at a time when the U.S. dollar has been strengthening for almost four months after weakening substantially in 2020 amid trillions of dollars Congressional spending, Federal Reserve asset purchases and a $6.3 trillion increase in the M2 money supply.

With inflation still high at 7.5 percent, the economy grew at an inflation-adjusted 5.7 percent in 2021 and the unemployment rate near historic lows at 4 percent, the economy appears to be overheating. Historically, that is when the central bank tends to hike interest rates.

The alternative would be for the Fed to keep the pedal to the metal in a desperate bid to keep interest rates low even while inflation was ballooning, only to careen over the edge into what could be an even worse recession.

In fact, low interest rates amid high inflation is exceptionally rare in modern economic history. Usually, interest rates tend to rise with inflation. When that relationship is not working, the economy can take a hit.

But not this time, as noted by Seeking Alpha’s Rida Morwa, who wrote in Dec. 2021 of the paradox of interest rates not rapidly rising to meeting inflation: “today, we are seeing a very interesting phenomenon, unseen in modern times. Inflation (as measured by U.S. Personal Consumption Expenditures) is running well above the 10-year Treasury yields, resulting in significant negative “real yields”! … This is a very interesting phenomenon, that we have only seen 3 times in the past 120 years in the United States: 1. During the Civil War 2. During and after World War I. 3. During and after World War II … The fourth time is happening right now!”

Morwa added, “In all cases, for obvious reasons, debt spiked to unusual levels… The Treasury markets are pricing-in continued loose monetary policy. The Government will let inflation take its course to ‘deflate’ the national debt’, rather than curb inflation as they have been telling us. So, it is no wonder that Treasury yields refuse to go higher than they are today!”

And that could mean trouble, Morwa warned: “The long-term Treasury yields (or 10-year yield) remain stubbornly low, signaling a recession or deflation is coming soon.”

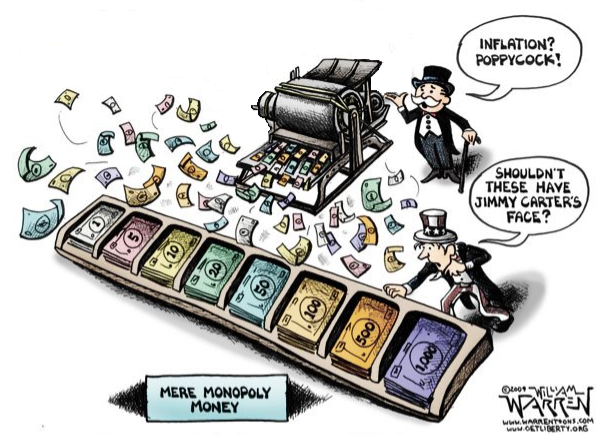

In fact, almost every dollar of new debt was printed. The national debt has increased by $6.8 trillion to $30 trillion since Jan. 2020, of which the Fed monetized half, or $3.4 trillion, by increasing its share of U.S. treasuries to a record $5.7 trillion while the M2 money supply, again, increased by $6.3 trillion.

The danger now for the Fed is that its planned rate hikes are coming so close to the end of the cycle, it will invite criticism that the central bank was the one who triggered the coming recession (even if one was going to happen anyway).

And if it results in a political wipeout for President Joe Biden and Congressional Democrats in the 2022 midterms, it could create a perverse incentive for future central banks to accommodate fiscal policy with more monetization and by leaving rates too low for too long — again.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

A version of this article appeared at algresearch.org.