By Rick Manning

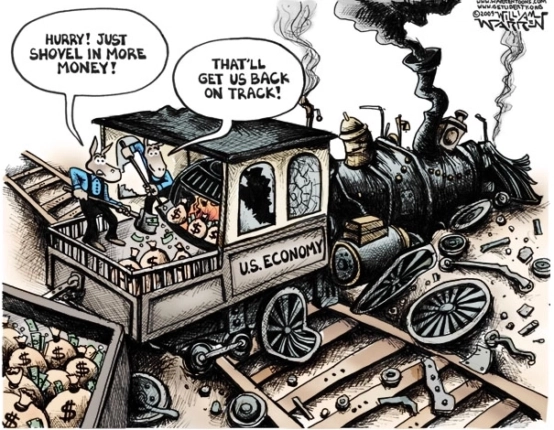

Joe Biden’s inflation has caused a banking crisis, which came to a head last year with the collapse of Silicon Valley Bank and Signature due to the near tripling of interest rates on new bonds, which destroyed the value of the low-interest bonds in their portfolios. When Biden chose to spend and spend and spend, he didn’t mean to cause banks to collapse, because he never believed that inflation would come back, but it did, and the banking industry is still trying to recover as a result.

In the meantime, the Federal Reserve has been taking low interest bonds off the market via the $163 billion Bank Term Funding Program for those too big to fail banks which help finance the left, attempting to avert a massive crisis.

Now, the Consumer Financial Protection Board (CFPB) finalized a rule on March 5 arbitrarily lowering late credit card fees in coordination with a broader set of government mandated price fixing schemes. Let’s be clear, no one likes higher fees.

However, let’s be clear about something else, late charges for failure to pay even the minimum due on credit card debt are a meaningful incentive for consumers to pay on time. The act of lowering these fees to a minimal amount will have the effect of creating more late payments as the cost of pushing the bill back in the pile in order to pay a different one will likely be viewed as insignificant.

What’s more, the Biden administration touts the overall savings to consumers without recognizing that many of our nation’s banks are still caught in the upside down interest rate world created by the Biden inflation economy. We saw two banks go under last year and many others struggling to meet federal liquidity requirements due to the decreased value of the bonds in their portfolios as inflation drove the open market interest rates for bonds higher.

Additionally, commercial real estate loans remain under pressure as many mortgage holders struggle in the post-pandemic work from home world to find tenants.

To make it all worse, the Biden administration is in the process of figuring out new capital requirement rules which put additional cash flow pressures on banks, particularly those who are not deemed ‘too big to fail’ and don’t qualify for bailouts from the Federal Reserve.

Finally, all of this comes at the same time that Congress is considering changing the way credit cards are processed to put more money which rightfully goes to the banking institutions into the pockets of retailers.

So, while it may be good election year politics for Biden to claim he is saving consumers money over what his administration calls, “excessive credit card late fees,” the rule will actually increase the number of people who are choosing to make late payments costing the lending institutions necessary cash flow generated from these payments.

In 2008, the financial system was on the brink of crashing. One of the dubious safeguards put into place was an ostensibly Federal Reserve run agency known as the Consumer Financial Protection Board, which received wide-ranging power over the banking industry.

Today that CFPB has been revealed for what it is. A political tool of the left as “its” decision to increase the numbers of those who are paying their credit cards late by lowering the cost of this choice in order to provide Joe Biden a talking point that he is, to quote the Biden Fact Sheet on the issue, “Fighting Corporate Rip-Offs.”

Due to the current law, Congress has no capacity to defund regulations of this now overtly political agency, as the CFPB is funded by the Federal Reserve. The Supreme Court is currently reviewing the constitutionality of the CFPB over this disconnect between vast regulatory power without any legislative oversight. Based upon today’s coordinated political action, there can be no doubt that this supposed independent agency is working hand in glove with Biden in a blatant attempt to increase his electability.

Elizabeth Warren’s brain-child is performing exactly as she envisioned it. An extra-constitutional, all-powerful agency which can coerce the financial industry through unbridled and unhinged actions designed to fundamentally transform the world’s system of capital distribution.

Let’s hope the Court notices and at least puts this Agency under Congress’ feckless review, so the people’s elected representatives have the opportunity to act, undoing policy decisions which do potential harm to America’s financial stability.

Rick Manning is the President of Americans for Limited Government.