Consumer inflation in the U.S. once again spiked upward to 3.5 percent over the last 12 months, or 0.4 percent the past month in March, according to the latest data from the Bureau of Labor Statistics.

The news comes as the Federal Reserve had been anticipating reducing the Federal Funds Rate this year as inflation had slowed down to 3.2 percent in February, but with the jump, the central bank might be putting those plans on hold.

Gasoline prices increased by 1.7 percent, although fuel oil was down 1.3 percent.

Electricity was up 0.9 percent, while piped gas service remained unchanged.

Other spikes came with apparel up 0.7 percent, transportation services up 1.5 percent and shelter up 0.4 percent and medical care services up 0.6 percent.

Of those, shelter is up 5.7 percent the past year, and transportation services are up a whopping 10.7 percent.

These were slightly offset by a 0.2 percent drop in new vehicles and a 1.1 percent drop in used cars and trucks.

All told, items minus food and energy are up 3.8 percent, meaning even as inflation has slowed down for food and energy — food is up 2.2 percent the past year and energy is up 2.1 percent — the prices for everything else are still moving northward.

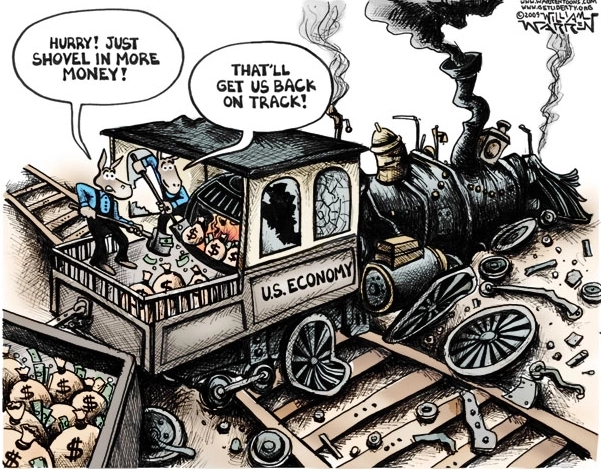

Meaning, the inflation is sticky and may be reasserting itself. The previous high was 9.1 percent in June 2022 after almost $7 trillion was printed for Covid, and while we are nowhere near that, it appears the Fed’s hopes that inflation would return to its normal 2 percent without a recession have been dashed.

Usually, when inflation goes up like that, eventually the economy overheats and ultimately a recession happens, with unemployment going up.

President Joe Biden had been promising that inflation could be righted without a recession, too, calling the tradeoff between inflation and unemployment a “false” choice.

So far, however, the unemployment rate has only increased from its April 2023 low of 3.2 percent to its current rate of 3.8 percent, not enough to squelch the inflation, apparently.

Personal income hasn’t kept up either, only rising 16.7 percent since Feb. 2021, while consumer prices are up 18.45 percent since that time.

And now with inflation heating up again, it is possible the U.S. has already proceeded to the next business cycle, or is about to, taking inflation with it and crushing incomes even further. If there was a soft landing or if the recession was in fact averted, the question might be at what cost. Be careful what you wish for.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.