06.29.2023

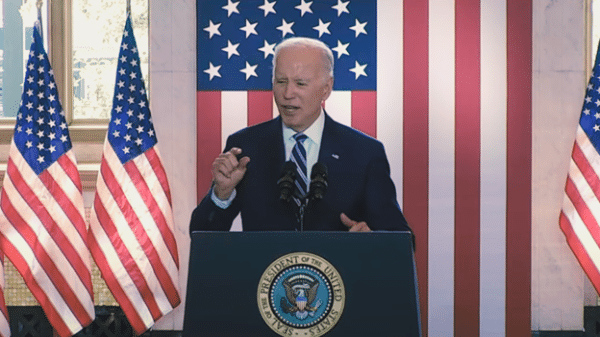

By Robert Romano President Joe Biden wants to run on the strength of the U.S. economy , in a June 28 campaign speech in Chicago Illinois , touting the U.S. as the “strongest economy in the world”. He might not have much choice — presidents are judged by the health of the economy in many respects when […]

06.28.2023

By Robert Romano “When you think about wages going up, when you think about inflation at its lowest by more than 50 percent than it was a year ago, that’s because of the work that this President has done. And he’s going to continue to focus on […]

06.27.2023

By Robert Romano “I’m not going to use the word ESG because it’s been misused by the far left and the far right.” That was Blackrock CEO Larry Fink on June 25 at Aspen Ideas Festival attempting to put some distance between himself and the Environmental, Social and Governance (ESG) investment model that directs investor funds to companies […]

06.15.2023

By Robert Romano The Federal Reserve has halted increasing its target interest rate, the Federal Funds Rate , at 5 percent to 5.25 percent, as consumer inflation reported by the Bureau of Labor Statistics continues to slow down, now down to an elevated 4 percent the past twelve months. Last month it was 4.9 […]

06.07.2023

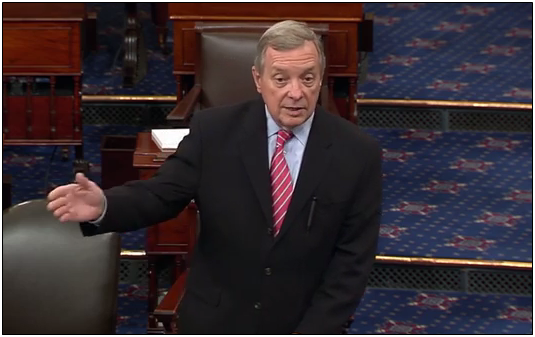

By Rick Manning Woke retailers like Target are lining up in support of what last year I called ‘smash and grab’ legislation worth billions of dollars by mandating changes to how credit cards are processed. Senator Dick Durbin succeeded in getting language put into the 2010 Dodd-Frank […]

06.02.2023

By Robert Romano The unemployment rate has ticked up off of historic lows to 3.7 percent in May, as 310,000 fewer Americans reported having jobs and those saying they were unemployed increased by 440,000, the latest data by the Bureau of Labor Statistics shows . That’s still pretty low by historic standards, but nothing lasts forever. Following […]

06.01.2023

By Robert Romano The U.S. House of Representatives easily passed H.R. 3746 , the Fiscal Responsibility Act, by a bipartisan majority of 314 to 117 on May 31 , with 149 Republicans and 165 Democrats voting in favor, and 71 Republicans and 46 Democrats opposed. The legislation, which now proceeds to the Senate, would suspend the $31.4 trillion national debt […]

05.31.2023

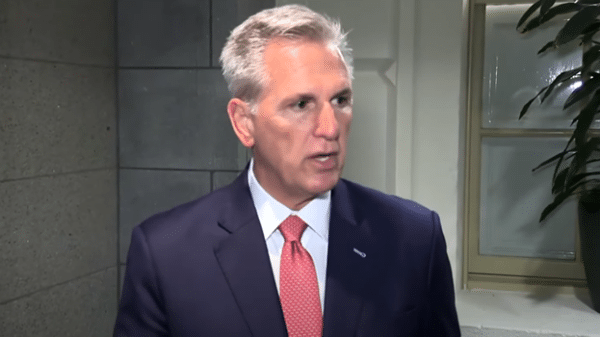

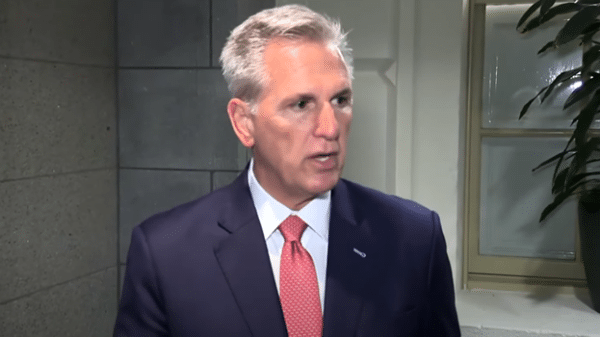

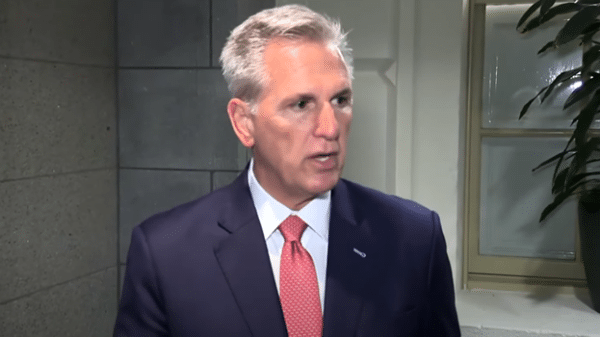

By Robert Romano “Just confirmed by the non-partisan @USCBO… This will be the LARGEST SPENDING CUT that Congress has ever voted for in history. $2.13 Trillion!” That was House Speaker Kevin McCarthy (R-Calif.) in a May 30 Twitter post pointing to a newly generated Congressional Budget Office (CBO) estimate of the Fiscal […]

05.22.2023

By Robert Romano There’s enough revenue to pay interest on the debt even if the $31.4 trillion debt ceiling is reached. Meaning, if the U.S. defaults on the debt on June 1, it will be because President Joe Biden chose not to make principal and interest payments […]

05.18.2023

By Robert Romano “[I]t’s not a revenue problem, it’s a spending problem.” That was House Speaker Kevin McCarthy (R-Calif.) speaking to reporters on May 17 following a meeting with President Joe Biden and Congressional leaders in both parties, attempting to reach an agreement on increasing the $31.4 trillion debt ceiling and budget spending […]