05.18.2023

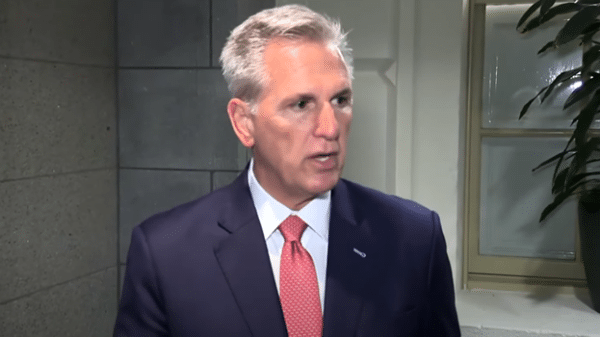

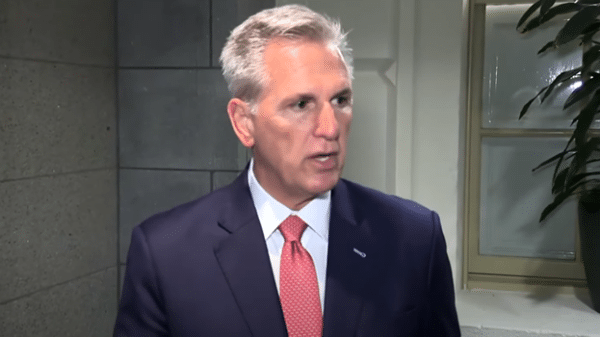

By Robert Romano “[I]t’s not a revenue problem, it’s a spending problem.” That was House Speaker Kevin McCarthy (R-Calif.) speaking to reporters on May 17 following a meeting with President Joe Biden and Congressional leaders in both parties, attempting to reach an agreement on increasing the $31.4 trillion debt ceiling and budget spending […]

05.10.2023

By Robert Romano Consumer inflation remained elevated in April, coming in at 4.9 percent over the past 12 months, according to the latest data published by the Bureau of Labor Statistics , in part due to a cut in oil production by OPEC+ globally that pushed gasoline prices higher, which increased 2.7 percent last month. The news comes after […]

05.08.2023

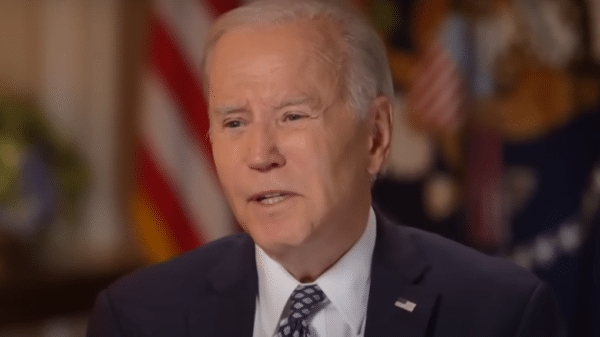

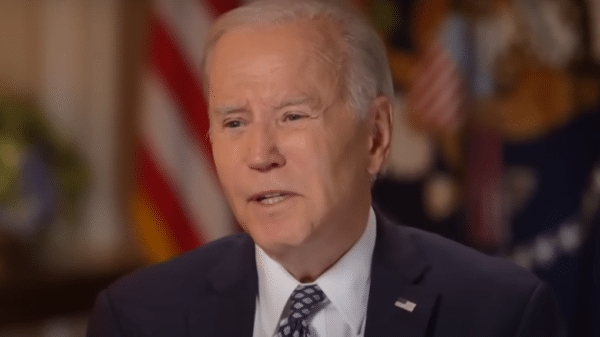

By Robert Romano “You just can’t. No one’s ever tied them together before.” That was President Joe Biden on MSNBC on May 6 , claiming that Congress has never increased the debt ceiling in exchange for budget, spending and regulatory changes. There’s only one problem. It’s completely false. Just in recent history, both the Budget Control Act of 2011 and the Contract With America Advancement Act of 1996 resolved disagreements between […]

05.05.2023

By Robert Romano The unemployment rate still remains at historic lows of 3.4 percent in April, according to the latest data by the Bureau of Labor Statistics , amid other worrying signs for the U.S. economy including a continued collapse of job openings, a string of bank failure and an overall slowing Gross Domestic Product (GDP). In the survey, as […]

05.04.2023

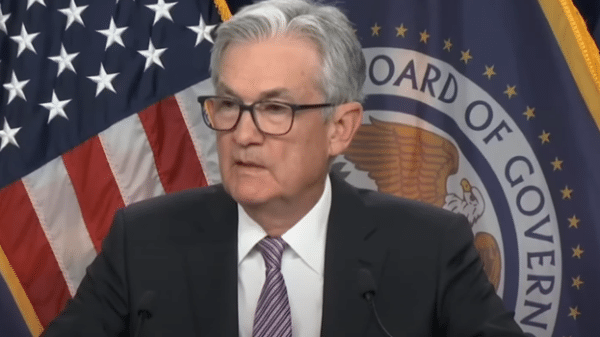

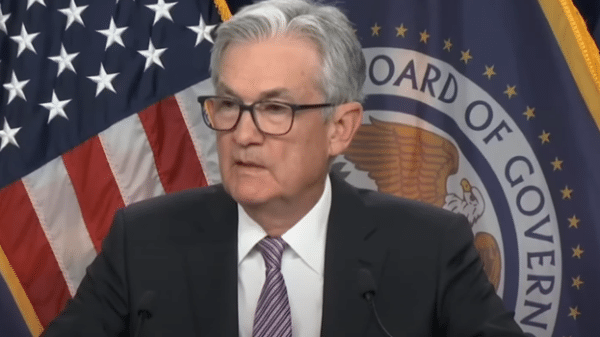

By Robert Romano The U.S. Federal Reserve has once again hiked interest that it charges banks in the wake of continued elevated inflation — which peaked at 9.1 percent in June 2022 — in a bid to calm what has been a lingering problem for the overheating economy, which slowed down to 1.1 percent annualized growth in the first quarter. Finally, the […]

05.01.2023

By Robert Romano The Federal Deposit Insurance Corporation (FDIC) and the California Department of Financial Protection and Innovation put the $229.1 billion California-based First Republic Bank into receivership today on May 1, while the FDIC also entered into a “purchase and assumption agreement” with JP Morgan-Chase Bank for the nation’s largest […]

04.26.2023

By Robert Romano After Tucker Carlson’s firing by Fox News, do high ratings even matter anymore? That might be a good question one might ask from Fox News’ termination of Carlson, the station’s most highly rated host, who was easily winning cable news’ battle for the 8pm […]

04.21.2023

By Robert Romano House Speaker Kevin McCarthy (R-Calif.) and the House Republican majority have unveiled their spending plan for the next decade, the Limit, Save, Grow Act , that will be tied to a $1.5 trillion increase in the $31.4 trillion national debt ceiling, the centerpiece of which imposes discretionary budget caps beginning in 2024 , but which will […]

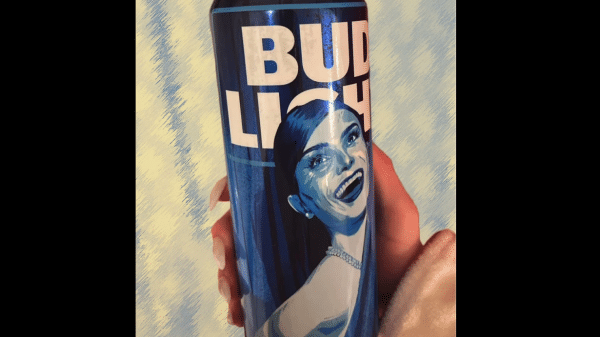

04.19.2023

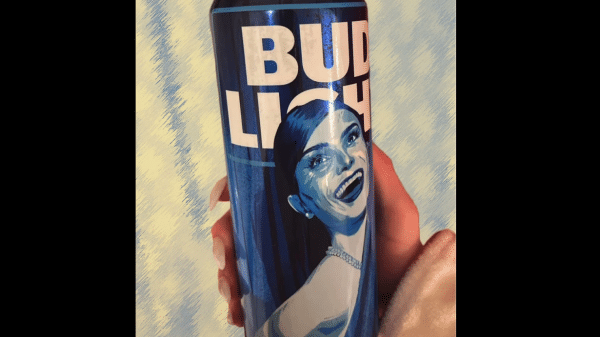

By Robert Romano America First Legal Foundation on April 17 filed a civil rights complaint against Anheuser-Busch at the Missouri branch of the U.S. Equal Employment Opportunity Commission, alleging violations of Title VII of the Civil Rights Act’s prohibition against employment discrimination on the basis of race and sex, blasting the […]

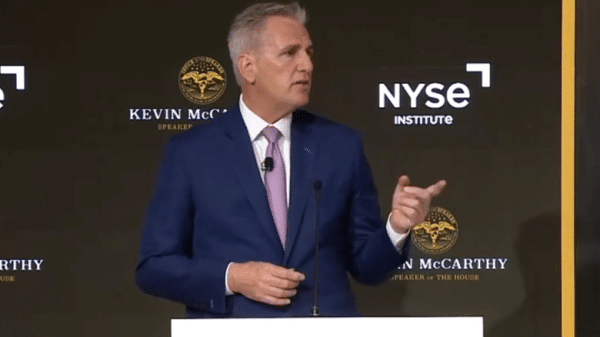

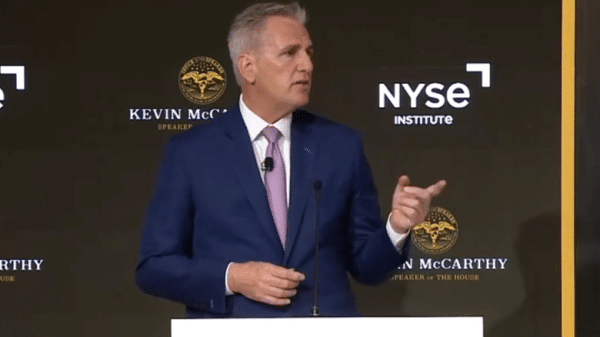

04.18.2023

By Robert Romano “A no-strings-attached debt limit increase will not pass.” That was House Speaker Kevin McCarthy (R-Calif.) in a speech to the New York Stock Exchange on April 17 foreshadowing the upcoming debate in Congress on increasing the $31.4 trillion national debt ceiling as the new House Republican majority […]