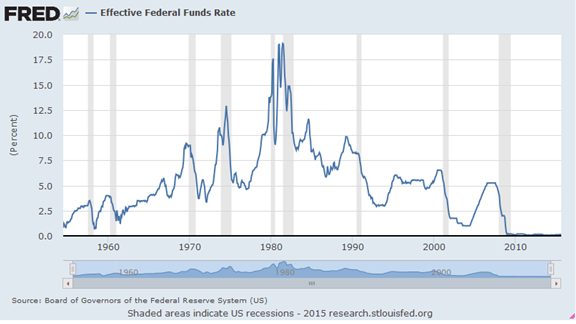

Is the Federal Reserve about to hike its key interest rate on Wednesday from near-zero percent that has been in place since 2008?

“The Federal Reserve will likely raise interest rates this week,” the Washington Post’s Ylan Q. Mui confidently predicts in Wonkblog. “Federal Reserve set to raise rates in ‘historic’ moment for global economy,” reports the UK Telegraph’s Peter Spence.

So it must be true, right?

And yet, looking at actual economic data, it is hard to countenance what exactly is the case for raising rates at this particular moment in time for the first time in seven years.

Oil is at $36 a barrel, a level not seen since 2004, and below its Feb. 2009 $39 low.

Consumer price inflation has only come in at 0.2 percent for all items in the past 12 months, and at 1.9 percent for all items less food and energy, reports the Bureau of Labor Statistics, right at about the central bank’s target rate.

Inflation-adjusted economic growth has been less than 3 percent since 2005, and less than 4 percent since 2000. 2015 looks abysmal so far at an annualized 2.2 percent for the first three quarters.

Interest rates on 10-year treasuries are as low as they’ve been in the entire Federal Reserve postwar dataset going back to 1953, with the exception of 2012.

Markets continue to correct in the Asia Pacific region, including China, which is in a full blown correction. Europe and Japan remain stagnated in depression.

In the above near-deflationary environment, what is the case for hiking rates?

Is the Fed telling us that this economy is running too “hot?” Really? Where?

Yes, the unemployment rate is technically low at 5 percent, but that is of a much smaller potential labor pool, thanks to a dramatic drop in workforce participation. As a result the employment population ratio of working age Americans aged 16 to 64 has dropped from an average level of 71.8 percent in 2007 to 68.9 percent, accounting for more than 4 million potential jobs lost from the economy since then.

Perhaps the real story, with an impending Fed rate hike, is that the Fed may believe we are on the brink of another recession — we average one every six to seven years anyway — and is worried it may have waited too long to hike rates.

In this sense, leaving rates at near-zero percent would leave the central bank less room to react when the economy returns to another recession.

Besides, the central bank tends to hike rates right before recessions, based on its own data.

That is not to say that Fed rate hikes are causative for determining recessions, although that is a commonly held belief. This author’s belief has been that market conditions, not central bank dictates, determine growth, interest rates and other key indicators.

Either way, whether the Fed’s rate hike on Wednesday might cause or merely be symptomatic of a recession, if and when it comes it could be a very bearish signal indeed. Buckle up.

Robert Romano is the senior editor of Americans for Limited Government.